Toronto startups make the home-buying process easier

Buying a house in Toronto is something I haven't cared to learn about until now. Sure, it's great to be educated about the home-buying process, but for me it was always depressing to learn about the sky-high condo prices downtown, where I want to eventually buy a property. So instead of researching mortgage rates and figuring out the difference between pre-construction and resale properties, I've been renting in ignorant bliss, slowly saving up for the elusive down payment.

This spring when I realized that by George, I might actually have enough to buy a place this decade, I set out to learn as much as I could about the home-buying process. While researching, I discovered a couple Toronto-based startups that are making buying a home a simple process for potential buyers, both pre- and post-purchase.

The first step to buying a home is figuring out the mortgage you can afford, and the type of mortgage you want. Toronto startup RateHub.ca, started by Alyssa Richard, is a mortgage education tool that helps prospective homeowners research information and compare rates. The site, which is free to use for consumers and makes money by referring homeowners to mortgage lenders, has what you would expect on a mortgage site - it compares rates based on term and based on banks and other brokers.

But the best parts of RateHub are the Education Centre and Mortgage Calculators. There's an affordability calculator that tells you how much you can afford based on your salary, and compares different amortization periods and includes applicable taxes; and a mortgage payment calculator that shows you what your monthly fees would be for a specific property. If you have no idea what an amortization period is, the education centre provides a wealth of videos, articles and fact sheets that takes you through the process of buying property in Canada. It's also tailored to where you live in Canada, so you can see local bylaws or exemptions. While the site may not replace working with someone at your bank, for me it's been a great place to get started.

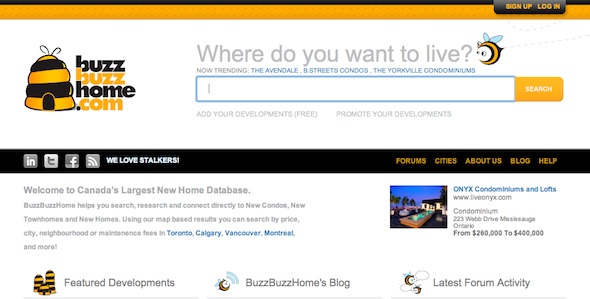

Once you know what you can afford, it's time to start looking for a property. I had no idea if I should get an agent, or search myself, or just wait until someone puts for-sale signs on my mailroom bulletin board. Local company BuzzBuzzHome has been a great tool for researching new condos, townhomes and homes across Canada (if you're looking for an old fixer-upper or an older apartment then this site probably isn't for you). Founder Matthew Slutsky says the idea was born out of frustration he felt while working for Toronto builders. "For me, it was a frustration that I experienced while working for Toronto builders, and seeing a huge gap of information in the new-construction industry that was not being filled," he says.

The site allows you to search by property development, and includes pre-construction as well as already completed properties. You can search by neighbourhood, project or price range, and you can contact the builder directly through the site for more information. They have a blog that covers sales centre openings and property trends in Canada, and active forums with threads of information about the home-buying process - it's where I've been researching whether to buy pre-construction vs. resale.

I still plan on using a real estate agent to find me a property in Toronto, but these resources have helped educate me on what I need to know before I seriously consider buying. And sure, they've depressed me a little (CMHC fees! Pre-construction down payments!) but at the same time they've opened my eyes to what it's like to be a property owner in Toronto. And hey, renting isn't so bad for now - just don't remind me that I'm paying someone else's mortgage.

Photo by rickpenner on Flickr

Latest Videos

Latest Videos

Join the conversation Load comments