This interactive tool shows you the cost of home insurance in your Toronto neighbourhood

Comparing the cost of home insurance rates is easy with an interactive tool that tells you the estimated annual cost based on location.

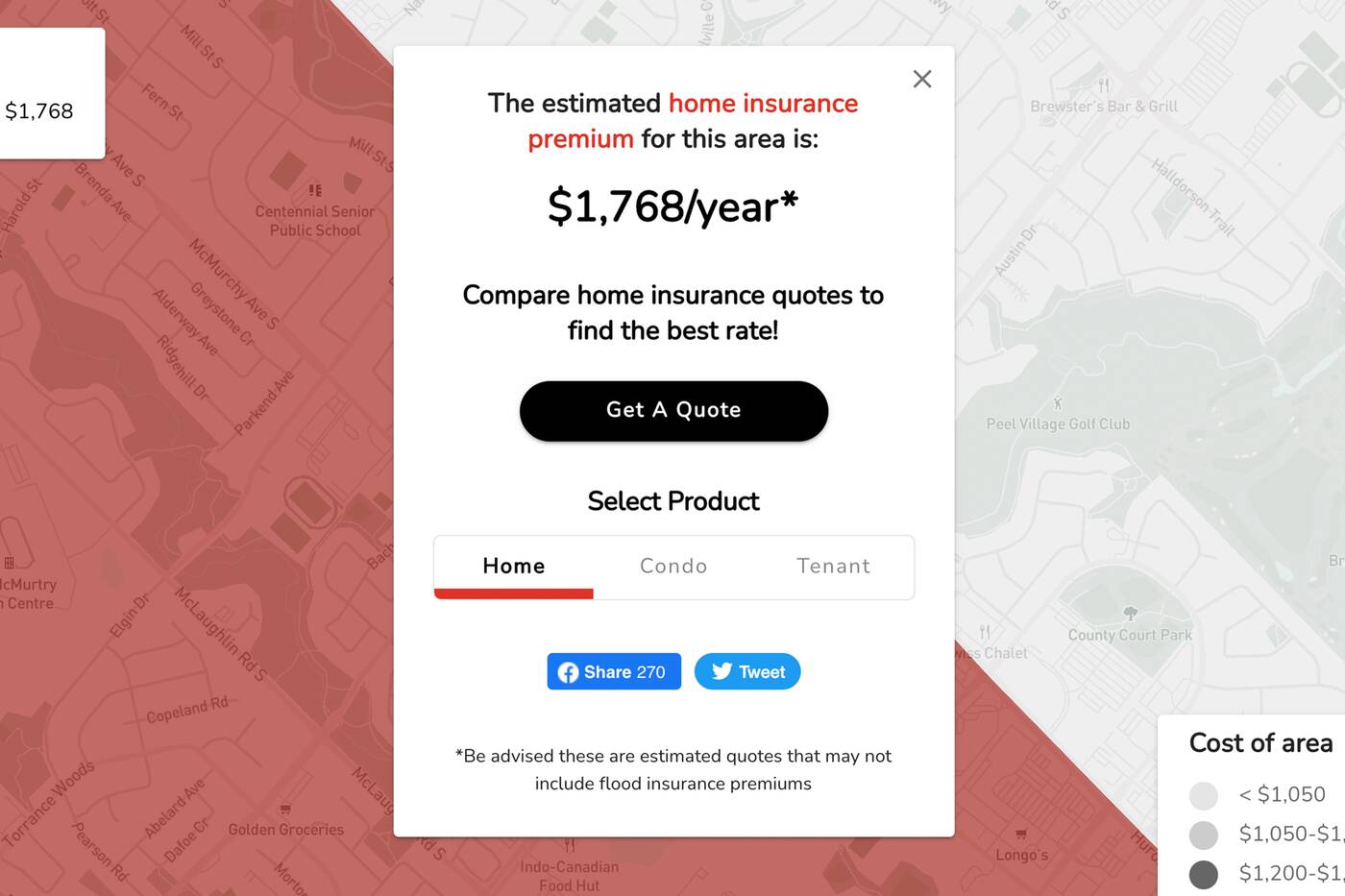

The RATESDOTCA interactive map tool, Home Insuramap, generates estimated annual home, condo and tenant insurance premiums for each postal code zone in Ontario.

If it shows up light grey, that means you are paying some of the lowest home insurance premiums. If it shows up red, that means you are paying some of the highest.

To get started, just enter your postal code and select what type of insurance you want to see estimated rates for — home, condo or tenant — and within seconds a rate will come up.

The interactive tool provides a home insurance estimate.

If you want the best rate for your specific home, you can quote by providing some basic information about your property – such as the address, age of the building, fire safety and theft prevention measures — the site will instantly compare different insurance company quotes and find the best deal.

The whole process takes less than five minutes and is as easy as searching for a hotel or flight online. The insurance providers are well-known companies such as Aviva, CAA and Desjardins Insurance.

Fun fact: The Greater Toronto Area has some of the lowest home insurance premiums in Ontario, according to RATESDOTCA — which might be surprising given the soaring costs of real estate in the city. People in northern and southern regions of Ontario are paying the most.

Home insurance is essential for home or condo owners as few banks or lenders will provide a mortgage without it. RATESDOTCA works with home insurance companies and brokers in Ontario to provide a broad selection of quotes.

"We quickly collect your information and use it to generate the best offers from each of our partners. Our service is fast, easy and free to use," RATESDOTCA says.

By comparing Ontario home insurance quotes from several insurance providers in a single place, people can instantly assess the market and find the best policy to protect your property.

Though home insurance isn't mandatory in Ontario, few banks or lenders will offer you with a mortgage if you can't prove that your house is protected by an up-to-date home insurance policy.

Insuring your home means you'll be protected from damage, liability and theft. Without home insurance, you'll be solely responsible for these expenses.

Excellent piece by @hscoffield on the importance of adapting to the ‘here & now’ challenges brought forth by climate change. We must play climate defence now to better protect Canadians. Re: financing - the public & private sectors both have roles to play. https://t.co/5uBNIBqRfe

— Don Forgeron (@IBC_CEO) December 2, 2021

Also, insurance claims for Canadians who suffer losses from severe weather are on the rise, according to the Insurance Bureau of Canada.

Over the last 15 years, Ontario has had three major weather events that caused damages in the billions.

In 2020 alone, Ontario suffered two major insurance damage claims due to weather. A southern Ontario snow and rainstorm caused $98 million, and in the fall a windstorm caused $88 million in damages, according to the Insurance Bureau of Canada.

Hector Vasquez

Latest Videos

Latest Videos

Join the conversation Load comments