Single people need to save for almost their entire adult lives to afford a home in Toronto

If you're a single person in Toronto who hopes to one day own a home, you may want to consider jumping on the "buying with friends and family" bandwagon, because a new report says you'll likely be saving for most of your life otherwise.

Canadian property listing site Point2Homes has used the latest average home prices, income levels and interest rates nationwide to determine how long residents will need to save for their first home in various locales right now, and for Toronto, the picture is pretty darn hopeless.

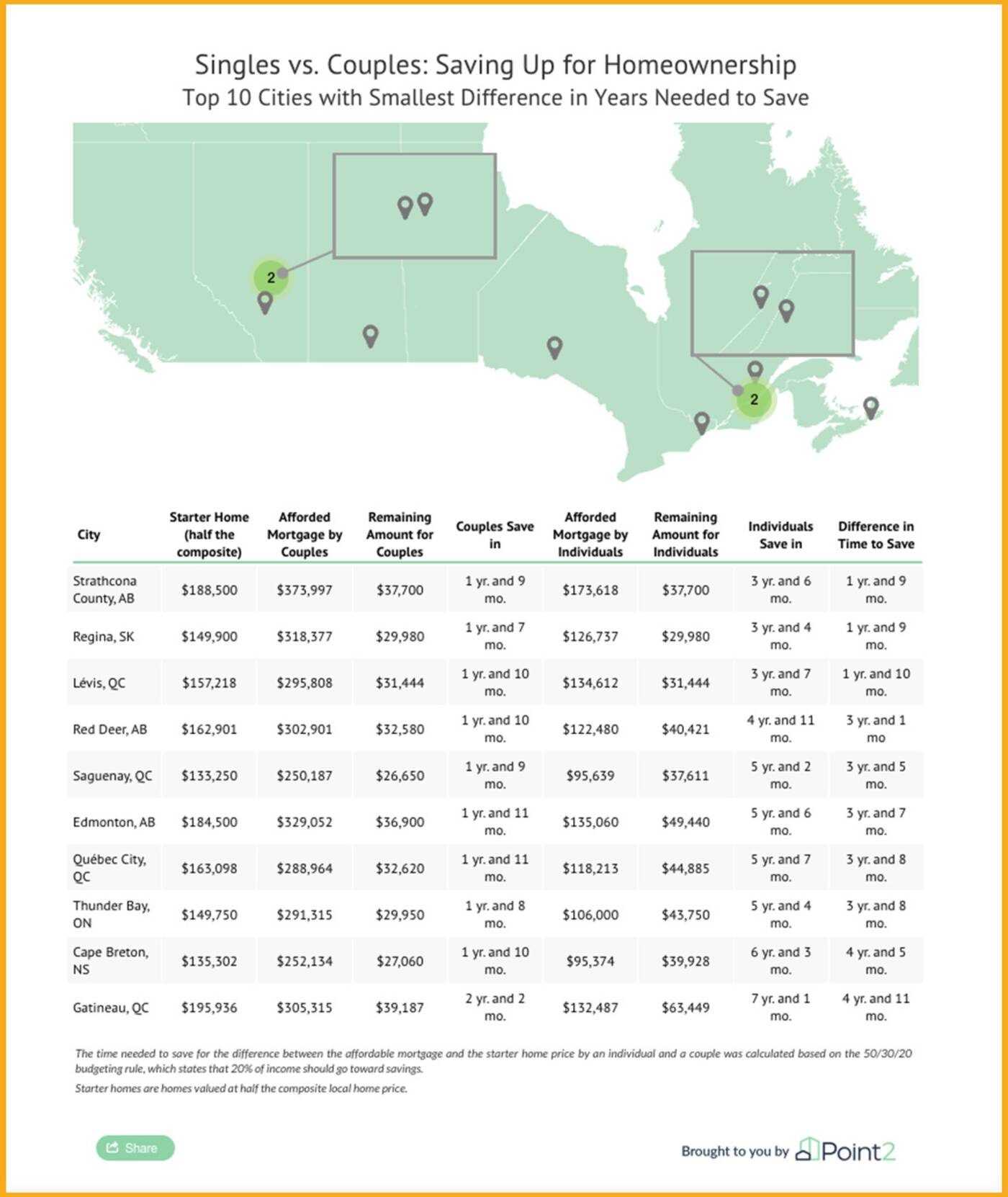

While an individual could save for the typical "starter" home in somewhere like Regina, Saskatchewan in about three years and three months (only a year and seven months if you're a couple), in Toronto, they would need to stash their cash for a mind-blowing 47 years and nine months (versus 11 years and 10 months for couples).

Starter homes hardly exist in Canada anymore but here's where you can still buy one https://t.co/SriLdktWkk #Canada #RealEstate

— blogTO (@blogTO) July 4, 2023

It's even worse for those dreaming of a life in certain GTA suburbs: in the affluent Oakville, Ontario, one would need to save up for approximately 51 years and 8 months (13 years and 10 months for couples).

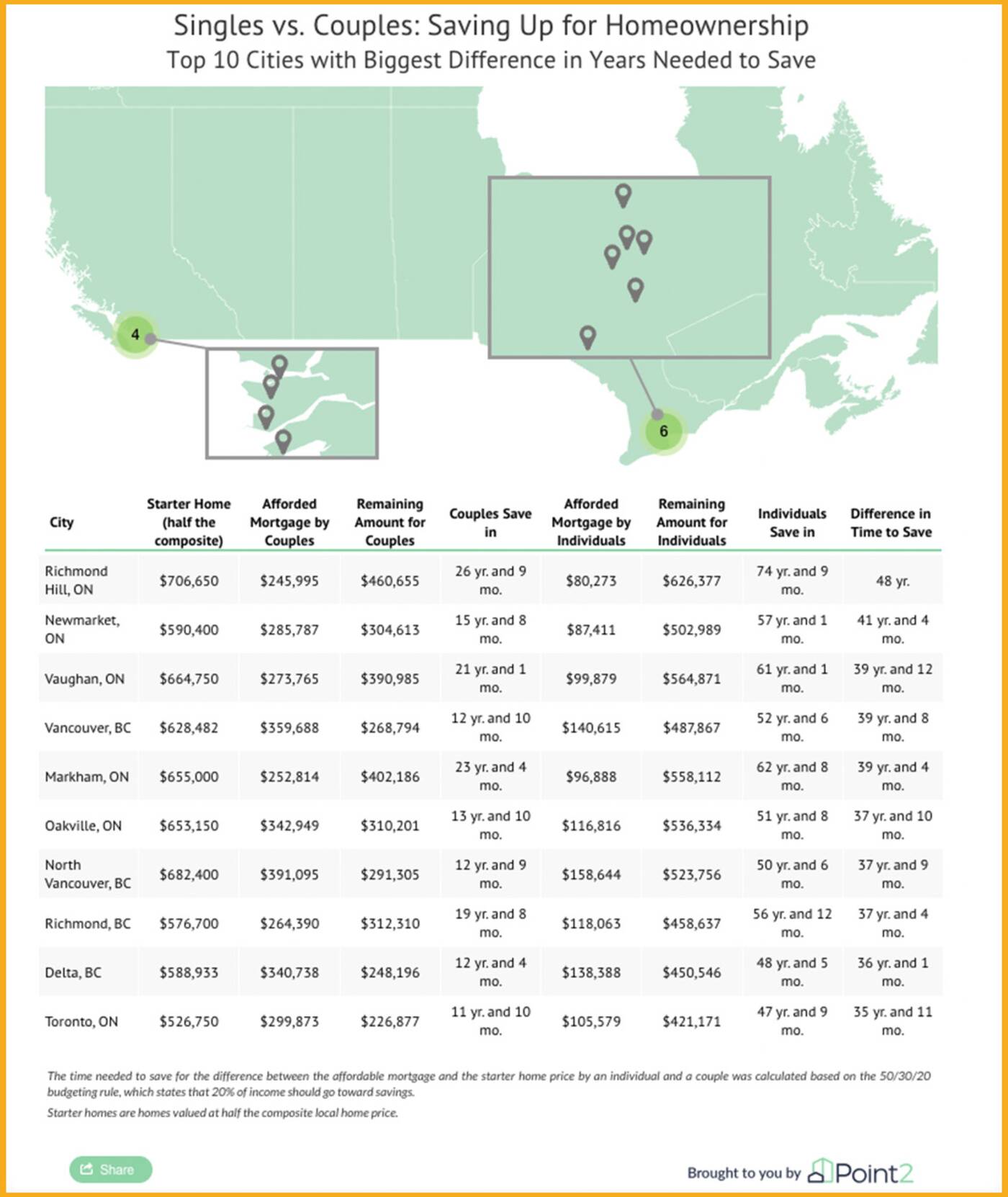

And in Richmond Hill, Ontario, Point2 estimates this figure to be a jaw-dropping 74 years and 9 months (26 years and 9 months for couples) — the longest in all of Canada, and just shy of the national average life expectancy.

All of these cities — along with Newmarket, Vaughan and Markham, ON — were among the top 10 places with the biggest difference in years needed to save depending on if you're single or part of a couple. Rounding out the Ontario-dominant list were Vancouver, North Vancouver, Richmond and Delta, B.C.

"Given the high home prices and the not-high-enough incomes in these cities, the amount that buyers would need to cover after securing a loan would still be prohibitive," the firm writes. "This would significantly limit first-time buyers' options, especially in cities where home prices have crossed the $1 million mark — and are still rising."

"Given the high home prices and the not-high-enough incomes in these cities, the amount that buyers would need to cover after securing a loan would still be prohibitive," the firm writes. "This would significantly limit first-time buyers' options, especially in cities where home prices have crossed the $1 million mark — and are still rising."

"Starter homes" don't really exist around Toronto and Vancouver anymore, and as Point2 notes, are increasingly hard to find anywhere in the country though they are "the only way for many would-be buyers to get on the property ladder."

For those looking for one, though, they are more likely to find something more affordable in places like Regina, Edmonton, Cape Breton, Quebec City, and others where it's faster for both singles and couples to save up.

Point2's numbers are particularly realistic because they assume only 20 per cent of one's income should be going towards savings (as per the 50/30/20 rule), and are based on the time needed to cover the difference between average home price and an "affordable" mortgage that won't eat up more than 30 per cent of their income.

Point2's numbers are particularly realistic because they assume only 20 per cent of one's income should be going towards savings (as per the 50/30/20 rule), and are based on the time needed to cover the difference between average home price and an "affordable" mortgage that won't eat up more than 30 per cent of their income.

Alan Possas/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments