Here are the most affordable cities in Ontario to buy a home right now

Preparing to purchase your first home in Ontario can be an incredibly daunting experience, given all the uncertainties that come with the region's real estate market through interest rates, increased competition, and sky-high prices.

For most of 2023, interest rates have remained high, leading to a feeling of uncertainty among both homebuyers and sellers about the province's housing market.

Although prices are still lower now than when they peaked in 2022, the average home price in Ontario was still $908,000 in August 2023, representing a 2.1 per cent drop from June 2023.

In order to find the most affordable areas in Ontario to purchase a home, Zoocasa compared the average monthly mortgage payment required for a home bought at the average price in each city.

Benchmark home prices for August 2023 were sourced from the Canadian Real Estate Association (CREA), while average monthly mortgage payments were calculated using the Ratehub affordability calculator, assuming a 20 per cent down payment with a 25-year amortization at a mortgage rate of 5.24 per cent.

It comes as no surprise that the top 10 affordable areas to purchase a home are all located outside of the GTA.

"As long as buyers are flexible and willing to look well outside the GTA, there are plenty of affordable cities in Ontario with homes for sale below $600,000," the study reads.

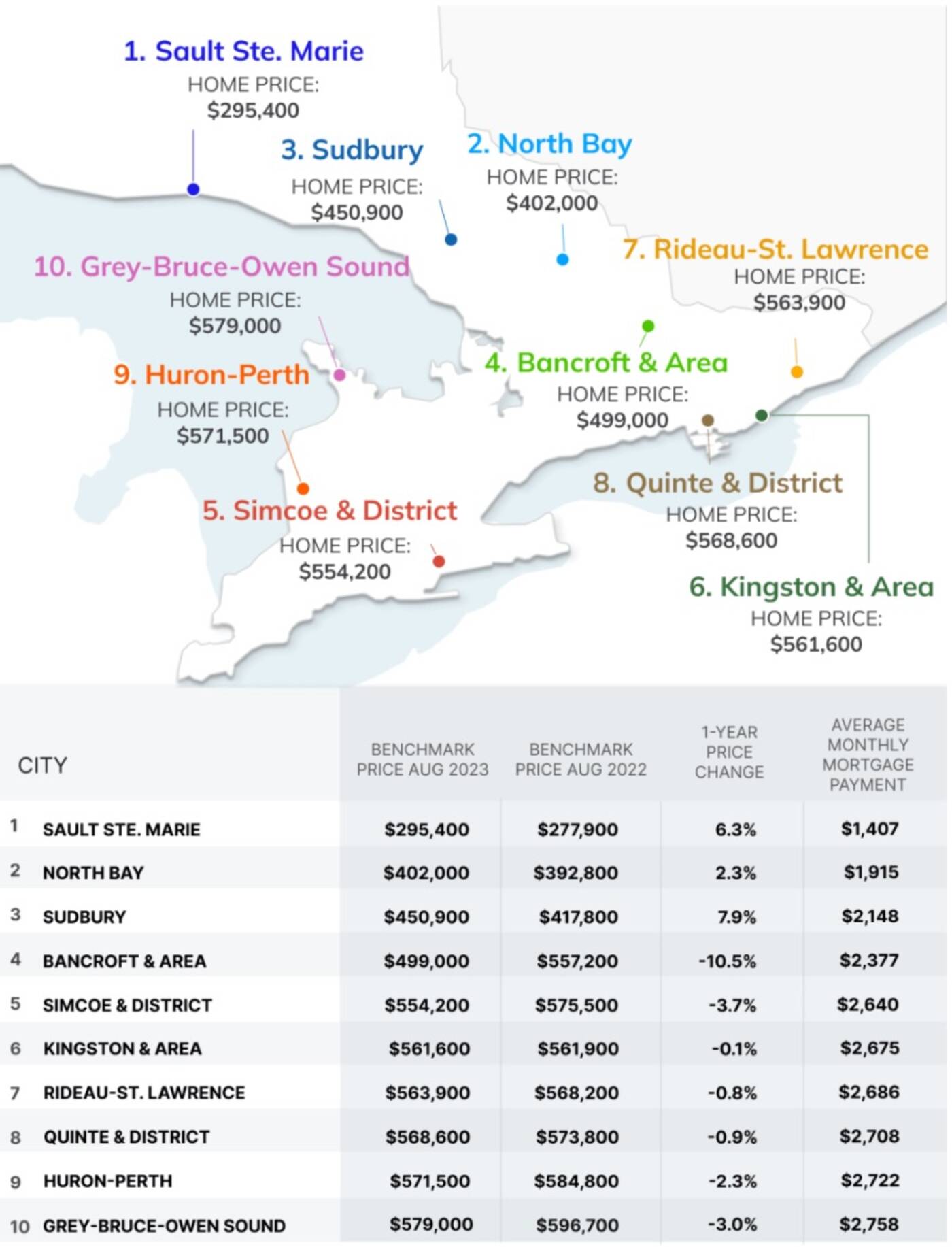

The 10 most affordable cities in Ontario to buy a home. Source: Zoocasa.

According to the brokerage, the top four most affordable cities to purchase a home in August 2023 were Sault Ste. Marie, North Bay, Sudbury, and Bancroft and Area, all of which have benchmark prices under $500,000.

In August 2023, Sault Ste. Marie had a benchmark price of $295,000, with an average monthly mortgage payment of $1,407.

The top four most affordable cities are unchanged from when Zoocasa conducted its last report, but Simcoe and District has now grabbed the fifth spot which formerly belonged to Kingston and Area.

New additions to the most affordable list include Rideau-St. Lawrence, Quinte and District, Huron-Perth, and Grey-Bruce-Owen Sound, all of which have benchmark prices between $560,000 and $580,000, with average monthly mortgage payments between $2,685 and $2,760.

Fareen Karim

Latest Videos

Latest Videos

Join the conversation Load comments