These are the best and worst GTA cities for property taxes

If you're looking to buy a property in the GTA (and aren't completely set in stone about which city to call home), considering factors like property taxes may help you decide which municipality matches your budget the best.

Property taxes can vary significantly from city to city, and are set by municipalities to cover the costs of services such as transportation, infrastructure, and maintenance.

These annual taxes are usually calculated as a percentage of the home value, and are often overlooked by new homebuyers, who may struggle to keep up with them as the years go on.

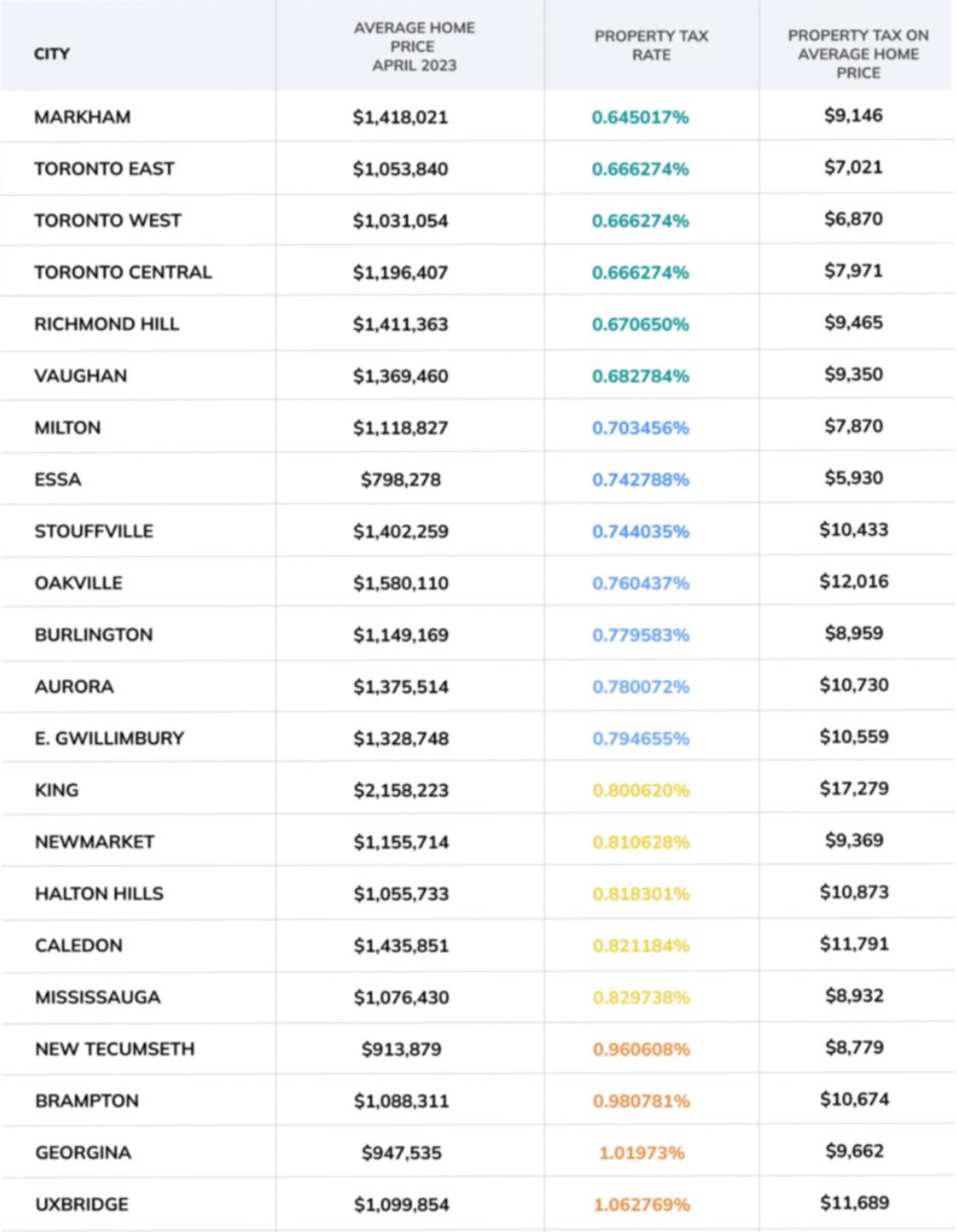

A new report by Zoocasa calculated the average amount of property taxes paid based on the municipal tax rate and average home price in 32 cities across the GTA. Average home prices were sourced from the Toronto Regional Real Estate Board, and property tax rates were sourced from each municipality's website.

The best and worst GTA cities for property taxes. Source: Zoocasa.

"In general, municipalities with higher average home prices have lower property tax rates, while the municipalities with more affordable average home prices have higher property tax rates," the report finds.

Out of all the municipalities analyzed, Markham boasts the lowest property tax rate at roughly 0.65 per cent, meaning a homeowner would pay $9,416 on an average-priced home of $1,418,021.

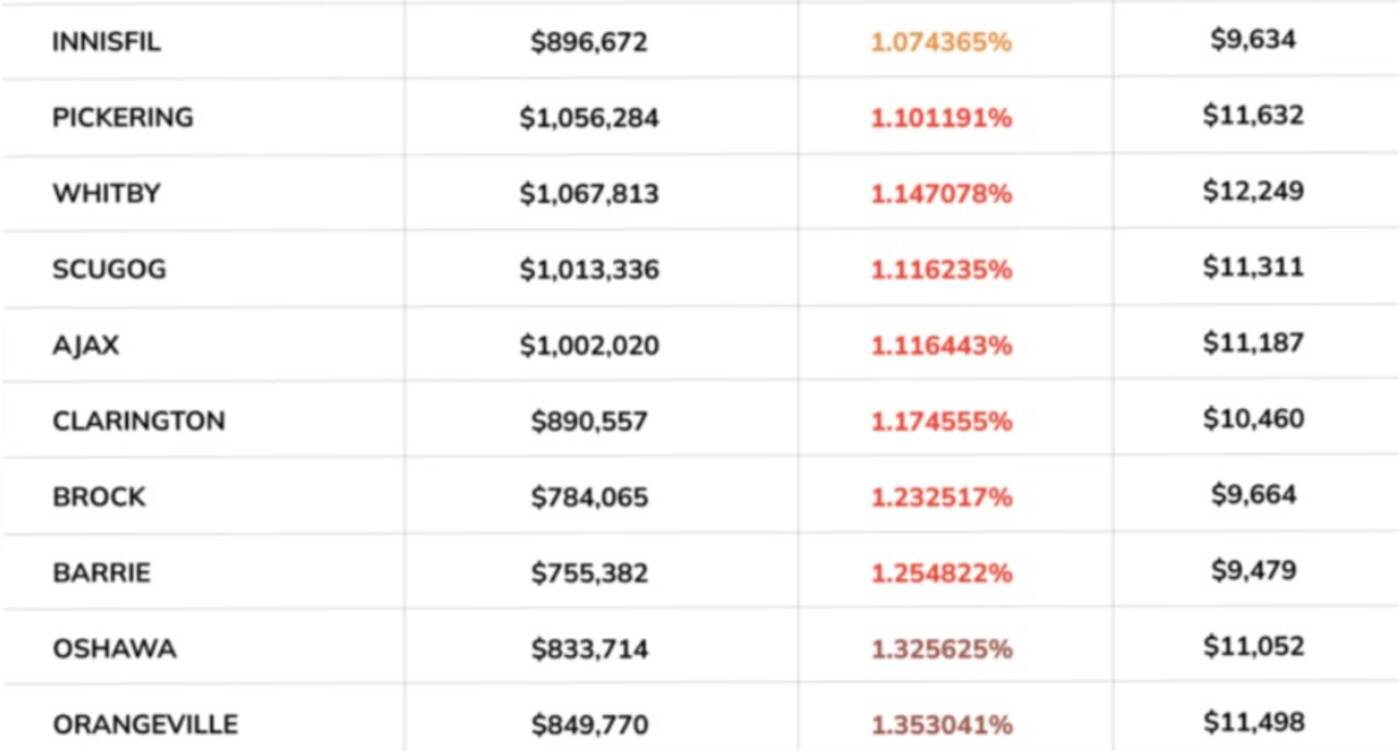

How property taxes vary across municipalities in the GTA. Source: Zoocasa.

The report found that Toronto East, Toronto West, and Toronto Central all have a property tax of roughly 0.66 per cent, meaning homeowners in this area have to dish out anywhere from $6,800 to just shy of $8,000 on an average-priced home.

Despite having average home prices above $1.4 million, the report reveals that Oakville, Richmond Hill, and Stouffville all carry property tax rates between 0.6 and 0.8 per cent.

The GTA municipalities with the highest property tax rate. Source: Zoocasa.

Out of all the cities analyzed, homeowners in Orangeville are faced with the highest property tax rate at 1.35 per cent and can expect to pay $11,498 in taxes on an average-priced home of $849,770.

Oshawa has the second-highest property tax rate at 1.32 per cent, with homeowners paying $11,052 on an average-priced home of $833,714.

Latest Videos

Latest Videos

Join the conversation Load comments