It's cheaper to own a home than rent in these Toronto neighbourhoods

Renting is widely considered the cheapest option to put a roof over your head, but a new study finds that is no longer the case in many Toronto neighbourhoods.

A string of successive mortgage rate hikes last year pushed many would-be homeowners into the rental market to wait out conditions. However, stabilizing home prices and an apparent end to the Bank of Canada's overnight lending rate hikes appear to have tipped the balance back in favour of home ownership.

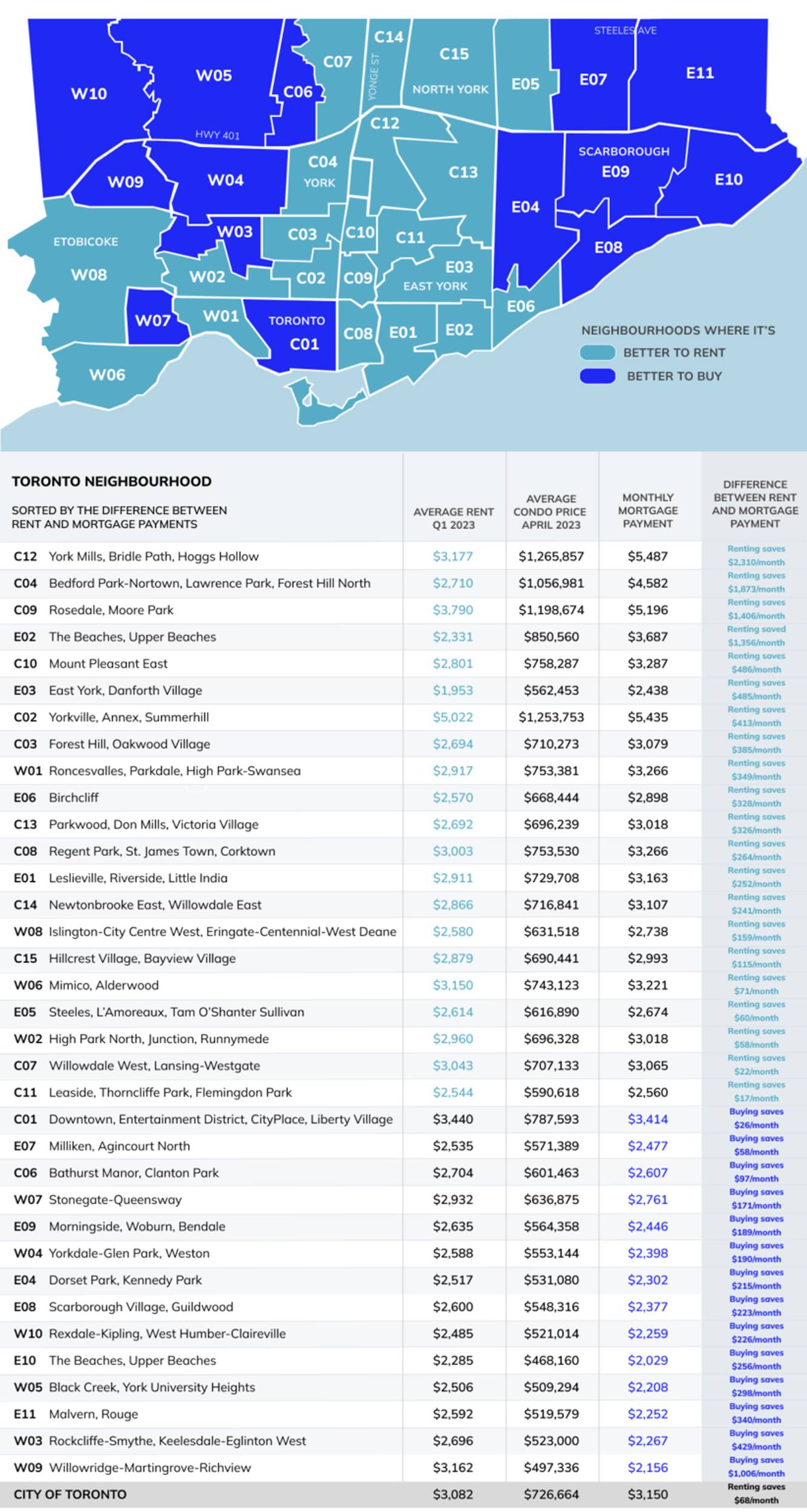

The report from Zoocasa analyzed data from the Toronto Regional Real Estate Board, determining that there are a whopping 14 neighbourhoods in Toronto where it's actually cheaper to pay off the local average mortgage rate than it is to pay typical rents in the city.

It may not be cheaper to purchase a home outright than it is to rent, however, the actual cost of home ownership in the form of mortgage payments has undoubtedly evened out with average rents across much of the city.

Toronto-wide, it will now cost a homebuyer only $68 more per month to pay the average mortgage on a condo apartment at the average price of $726,664 than the average monthly cost to rent an apartment.

If you were to extend that mortgage's amortization period over 30 years as opposed to 25, the average mortgage payment slips to $221 less per month than the price of rent.

Among the 35 neighbourhood zones listed on the Toronto MLS, 21 have mortgage rates that exceed the average Toronto rent, though the remaining 14 areas offer average mortgage payments that fall below the typical monthly cost of an apartment.

Of the 14 neighbourhoods where it's cheaper to rent than pay a mortgage, the cheapest condos can be found in MLS zone E10 (Rouge), where monthly mortgage payments on an average condo price of $468,160 come to $2,029, $256 a month cheaper than average rents.

But the widest gap between mortgage and rent payments is in MLS zone W09 (Willowridge-Martingrove-Richview), where rent costs $1,006 more than the $2,156 a month buyers would pay on their mortgage.

Of the 35 MLS zones/neighbourhoods in Toronto, 14 offer average mortgage payments that are actually more affordable than paying rent. Image via Zoocasa.

Among the 21 areas where it costs far more to own than rent, only four have mortgage payments costing $1,000 more than rental payments, including C12, C04 (Bedford Park-Nortown, Lawrence Park, Forest Hill North), C09 (Rosedale, Moore Park) and E02 (The Beaches, Upper Beaches).

The most expensive of the bunch is zone C12 (York Mills, Bridle Path, Hoggs Hollow), where a typical mortgage payment will cost an astonishing $2,310 more than renting.

Jack Landau

Latest Videos

Latest Videos

Join the conversation Load comments