Toronto millennial renters must save years longer than homeowners to retire

While it's no longer news that millennials are being priced out of homeownership in Toronto, a recent study shows that being a renter could cost locals at least three years of retirement.

The 2023 Mercer Retirement Readiness Barometer released Wednesday looks at how millennials' savings stack against each other, comparing homeowners and renters.

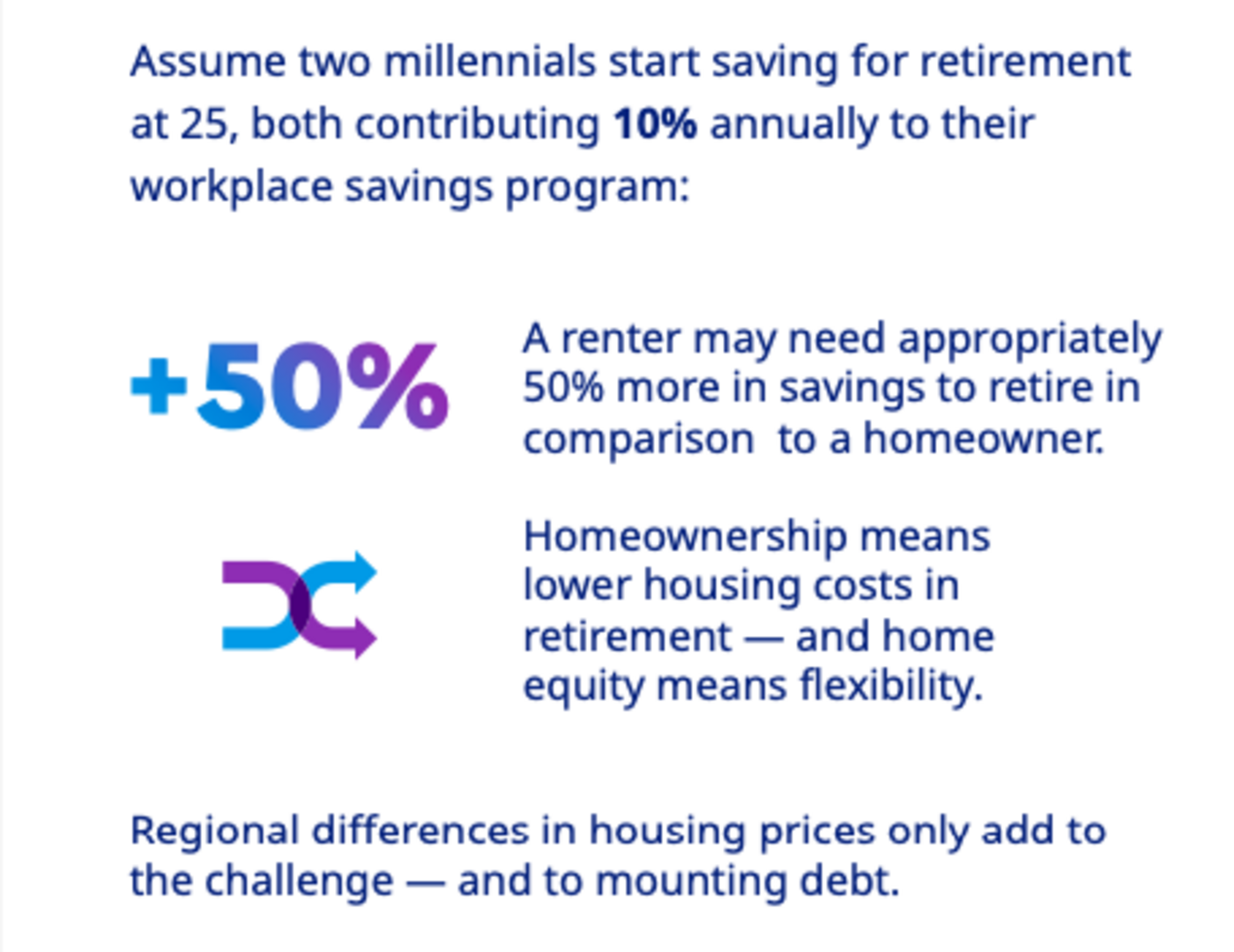

For this study, Mercer assumes both millennial personas have a starting salary of $60,000 and consistently save 10 per cent of those earnings from the age of 25.

Researchers then weighed the average Canadian home price of $500,000 from the Canadian Real Estate Association and compared it to the nation's average rent of $2,000 per month.

The finding: home ownership provides a significant advantage to retirement readiness.

Mercer defines retirement readiness as "a 75 per cent probability of not running out of money before death, if an appropriate level of income – which is 69 per cent for millennials — is maintained throughout retirement, including government benefits."

And in order to achieve said "reasonable income in retirement", Mercer says a millennial who rents for their entire career would need to save eight times their salary to retire at age 68.

That same millennial, if they own their home, would only need to save over five times their salary and be able to retire at 65 — three years earlier.

According to Mercer, there exists a gap because a home is a big part of one's equity, besides their government benefits and personal savings that all go towards a comfortable retirement.

In Toronto's reality, the median total household income per the 2021 census was $84,000. One-person households are on the rise and make up over 30 per cent of the city's population, with a median income of $45,200.

About 48 per cent of city dwellers were renters in 2021. Meanwhile, a single detached home had a median sale price of $1,205,000 in late 2022.

Understanding that these figures are much off from their national study's baseline, Mercer Canada's financial wellness leader Jillian Kennedy highly encourages regional discussions — and says the situation shouldn't be looked at as doom and gloom by all generations, especially millennials.

"Today, we see a common linear lifestyle — go to school, graduate, find a job, buy a house... But someone could have done everything right and still can't afford a down payment or even rent," Kennedy tells blogTO.

"As a society, we will see this resilient generation adapt to reality in different ways. For example, many are already buying cottages to move into in retirement, or sharing a home to afford ownership as group."

She adds that workers looking to secure their wealth have options; notably, take advantage of what retirement programs their employers are offering.

People may choose to work additional years, or to delay commencing government benefits like Canada Pension Plan (CPP) or Old Age Security (OAS) to boost the amount received each month.

Latest Videos

Latest Videos

Join the conversation Load comments