Toronto has the largest gap between rent prices and mortgage payments in Canada

Should you rent or should you buy? The age-old debate never seems to have a clear victor, especially when you factor in inflation, interest rates, and your location.

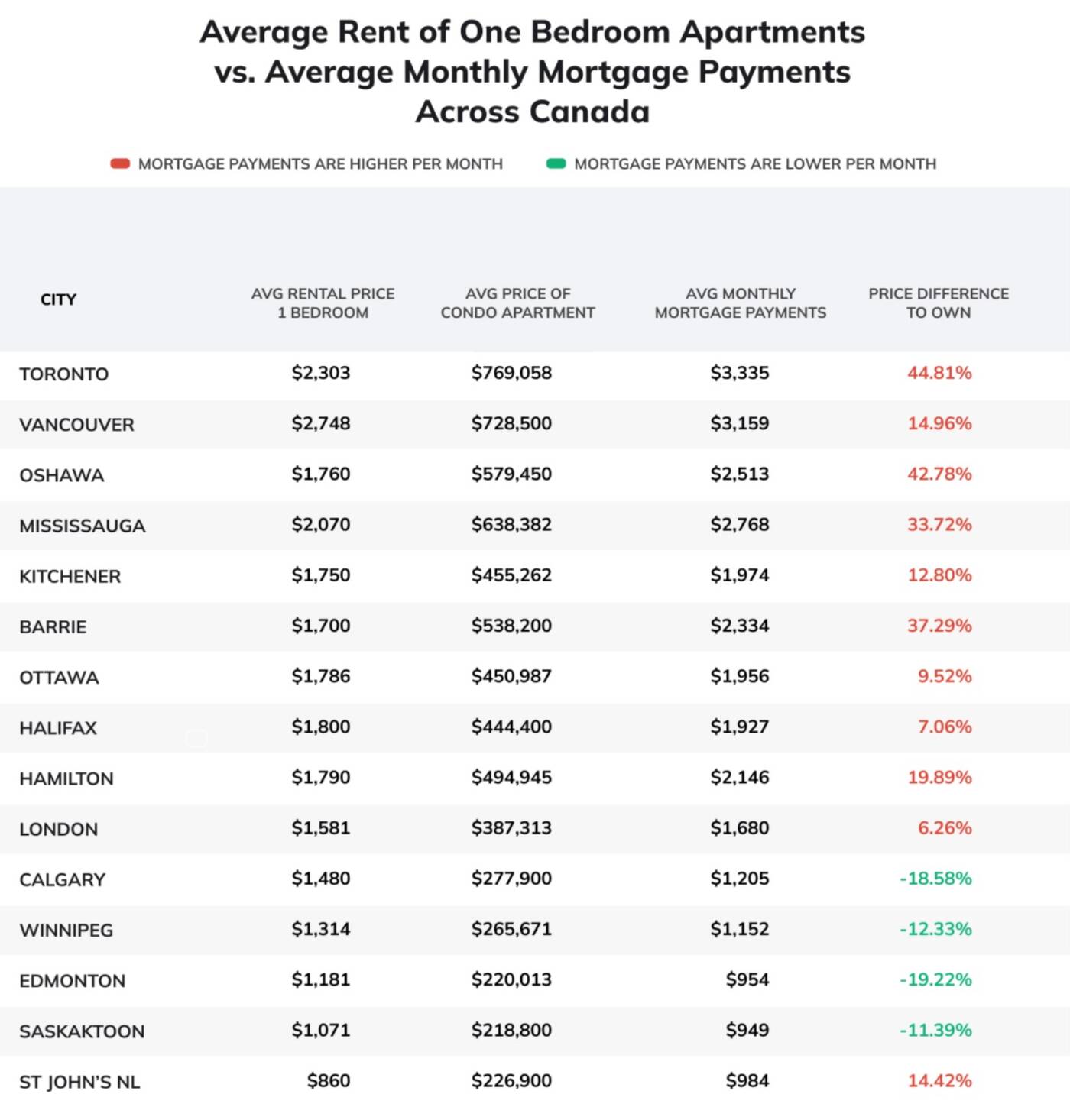

A new report by Zoocasa, with data from TorontoRentals.com, Zumper.com, RateHub.ca and Rentals.ca found that Toronto has the largest gap between rent prices and mortage payments.

Calculations reveal that, while the average rental price for a one-bedroom rental unit in Toronto is $2,303, average monthly mortgage payments in the city stand at $3,335, which means a 44.81 per cent price difference to own.

Rental prices have managed to grow by 21 per cent year-over-year in Toronto, according to data from TorontoRentals.com. On the other hand, home prices across the GTA have dropped following price peaks in early 2022.

Photo Credit: Zoocasa. Data courtesy of: Zumper, TorontoRentals.com, Rentals.ca, TRREB, the CREA MLS Home Price Index, RateHub.ca

Other Canadian cities with considerable gaps between rental prices and average monthly mortgage payments include Oshawa, Barrie, Missisauga, and Hamilton.

However, in other Canadian cities, buying is still considered a more cost-effective option, with average monthly mortgage payments being less expensive than rental prices in Calgary, Winnipeg, Edmonton and Saskatoon.

According to Zoocasa, "interest rate hikes impact rental and housing markets differently. For rental units, interest rate hikes drive the price up, whereas in the real estate market, it puts downward pressure on the cost of homes."

While choosing to rent or buy may be a difficult decision, it's worthwhile to consult a qualified agent in order to get the best bang for your buck amidst inflation and rising interest rates.

Hector Vasquez

Latest Videos

Latest Videos

Join the conversation Load comments