Home prices around Toronto expected to fall as much as they've risen

At the peak of the pandemic, many GTA municipalities and Southern Ontario towns saw home prices rise dramatically, but a new report suggests they'll likely decrease just as much — and it's already happening.

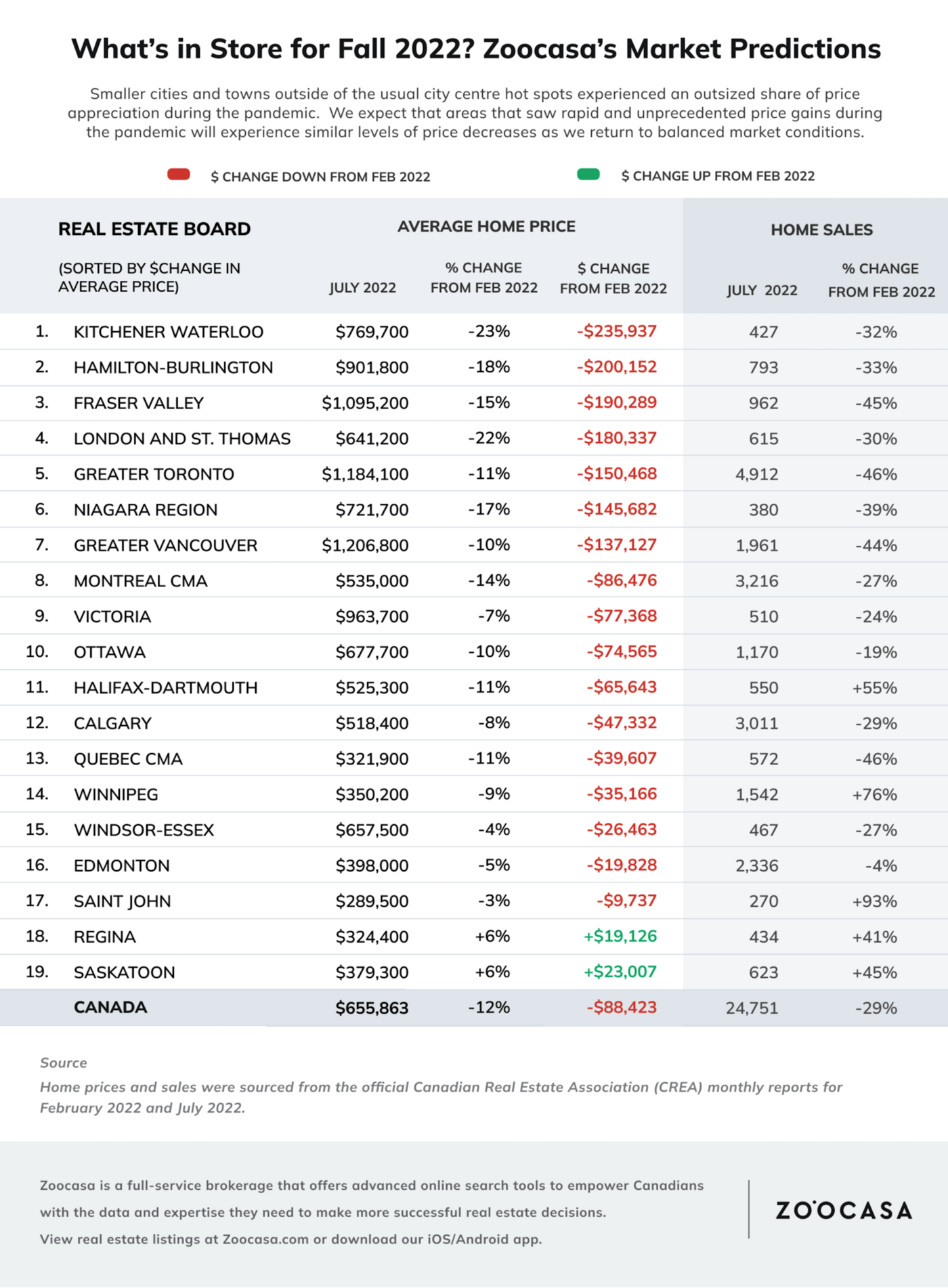

The new Zoocasa report, published this week, says the 2022 housing market is recalibrating following a record-breaking year in 2021.

"As the real estate market adjusts to the receding pandemic, we expect that areas that saw rapid and unprecedented appreciation during the pandemic will experience similar levels of price decreases as we return to balanced market conditions," reads the report.

Areas such as Kitchener-Waterloo and Oshawa both saw major price increases for detached homes, but prices have already begun to drop drastically.

Kitchener-Waterloo saw five consistent months of record-breaking home sales from November 2020 to March 2021, and the average sale price of all residential properties sold in February 2021 increased by 32.1 per cent compared to the same month the previous year.

But the average home price in the region dropped by 23 per cent, or $235,937, from February 2022 to July 2022.

In Oshawa, the average price of a detached home dropped from $1,218,317 to $855,400 between February and August, a decrease of 29.79 per cent.

It's a similar story in much of Ontario. And in the GTA as a whole, prices have fallen 11 per cent, or by $150,468, since February.

It's a similar story in much of Ontario. And in the GTA as a whole, prices have fallen 11 per cent, or by $150,468, since February.

Zoocasa also predicts that increasing interest rates will continue to impact housing inventory and keep many out of the housing market, at least for the foresseable future.

The brokerage also expects to see more motivated sellers in the market, which is good news for motivated buyers.

"At the beginning of the year, we saw a lot of fear-based trends. Buyers and sellers alike had the fear of missing out, but also of overpaying,” said Lauren Haw, CEO and Broker of Record at Zoocasa, in the report. "Now, buyers are experiencing more negotiating power and motivated sellers are adapting to the more recent market conditions."

Latest Videos

Latest Videos

Join the conversation Load comments