Toronto's housing market is facing one of its deepest declines of the past 50 years

A recent report by RBC Senior Economist Robert Hogue reveals that Toronto's housing market is experiencing a deepening downturn.

The reports said the Toronto housing market is seeing a decline in activity that is "quickly becoming one of the deepest of the past half a century."

According to Hogue, this decline can be attributed to soaring interest rates, higher borrowing costs, and reduced purchasing budgets for home hunters.

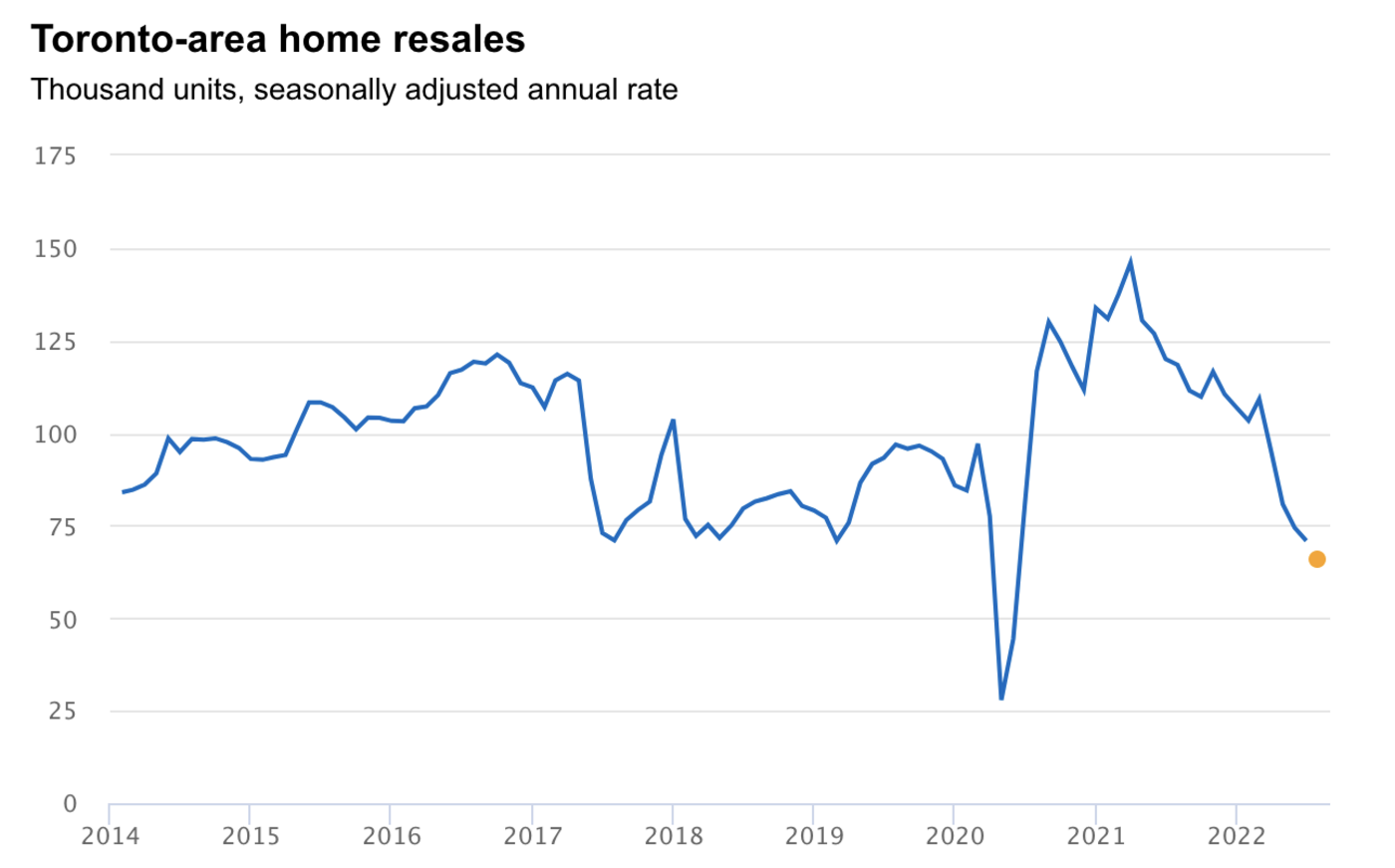

The report reveals that home sales in Toronto have fallen to its slowest pace in 13 years, if we exclude the April 2020 lockdown.

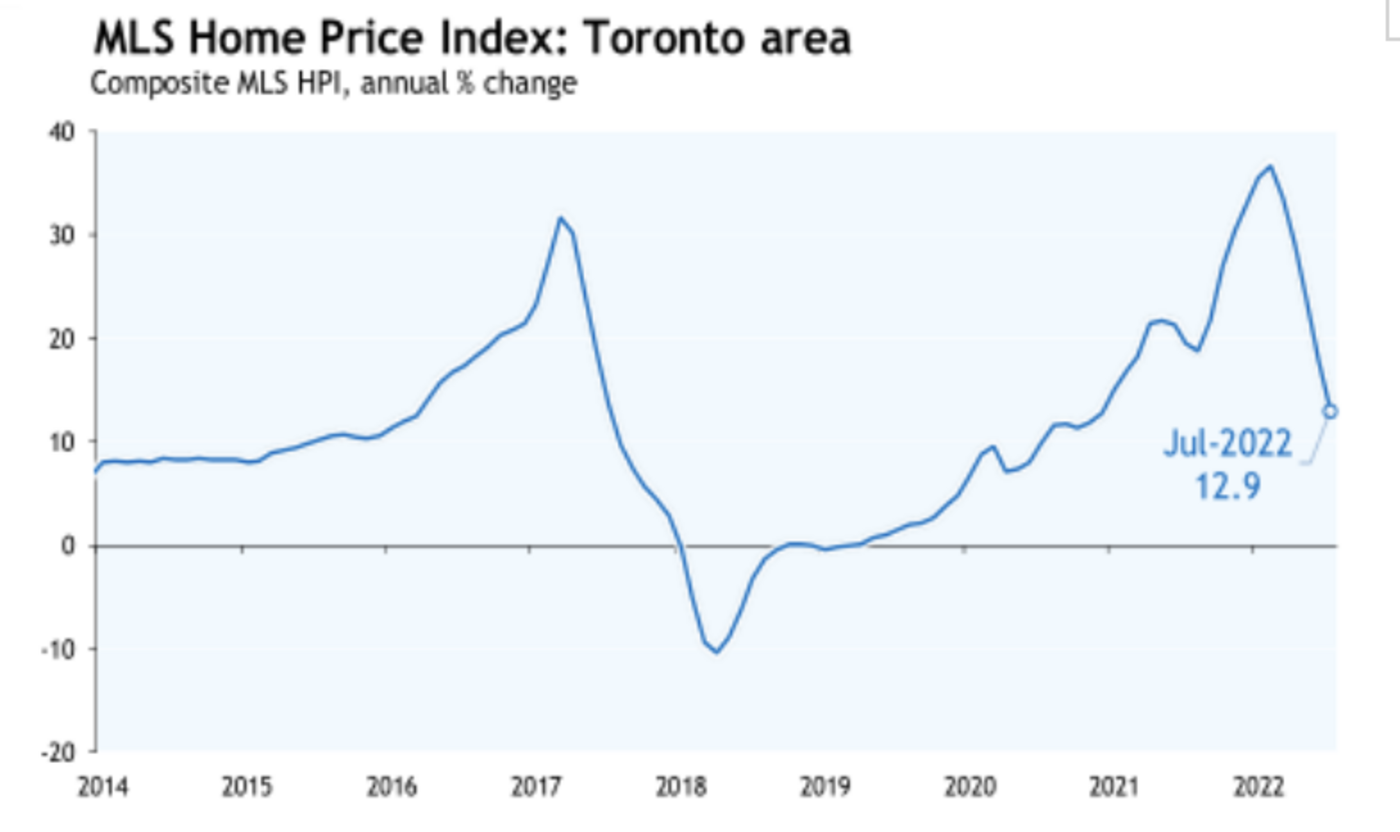

Photo Credit: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics

Activity has dramatically quieted, as higher interest rates are taking a huge toll on the market. Inventories, however, have been steadily climbing, up 58 per cent since 2021.

"The frenzy that took Toronto's market to unprecedented height this winter is completely gone," Hogue said.

The RBC economist said since March, the MLS Home Price Index has dropped $178,000, falling to $1.16 million. In July alone, prices declined almost 4 per cent, or $47,000.

"With more options to choose from and higher interest rates shrinking their purchasing budgets, buyers are able to extract meaninful price concessions from sellers," Hogue wrote in the report.

Photo Credit: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics

Hogue said the downturn is expected to intensify and spread further as many buyers in Toronto will take a wait-and-see approach.

"Canada's least affordable markets Vancouver and Toronto, and their surrounding regions, are most at risk in light of their excessively stretched affordability and price gains during the pandemic," the economist said.

The RBC expert expects that home buyers in the GTA will find better deals in the outskirts of Toronto, even though condos prices are to remain more resilient.

Latest Videos

Latest Videos

Join the conversation Load comments