Someone is trying to sell a small fraction of their Toronto condo for $20K

Look, affording a house in Toronto on a normal person's salary is basically impossible.

According to the latest stats, you need to be making at least $223,000 a year and still have a hefty down payment.

And if you don't have a regular 9-to-5 type job, getting a mortgage can be a struggle.

A digitally enhanced picture of the living room and kitchen.

But there is a possible alternative for anyone who is looking to get into the real estate market but can't do it in the conventional way. It's called fractional real estate investing.

Essentially, you're buying a portion of the property and your payments go towards increasing the percentage you own.

This one-bedroom, one-bathroom condo at 15 Stafford St. is currently listed for $19,650 but if you "bought" this place you'd only be buying 2.5 per cent of the condo, which is valued at $786,000.

The kitchen.

According to the listing, the monthly payment is $2,578.13, which includes maintenance fees and taxes.

"This is your opportunity to get off the rental treadmill and build your ownership incrementally," realtor Mark McLean says in the listing.

A digitally enhanced view of the kitchen and living area.

"The more you put down the less your monthly payment. There is no lock in period, and no mortgage qualification, just a simple application process."

Not a terrible deal for a pretty average condo in King West and it's a decent way to get exposure to the real estate market.

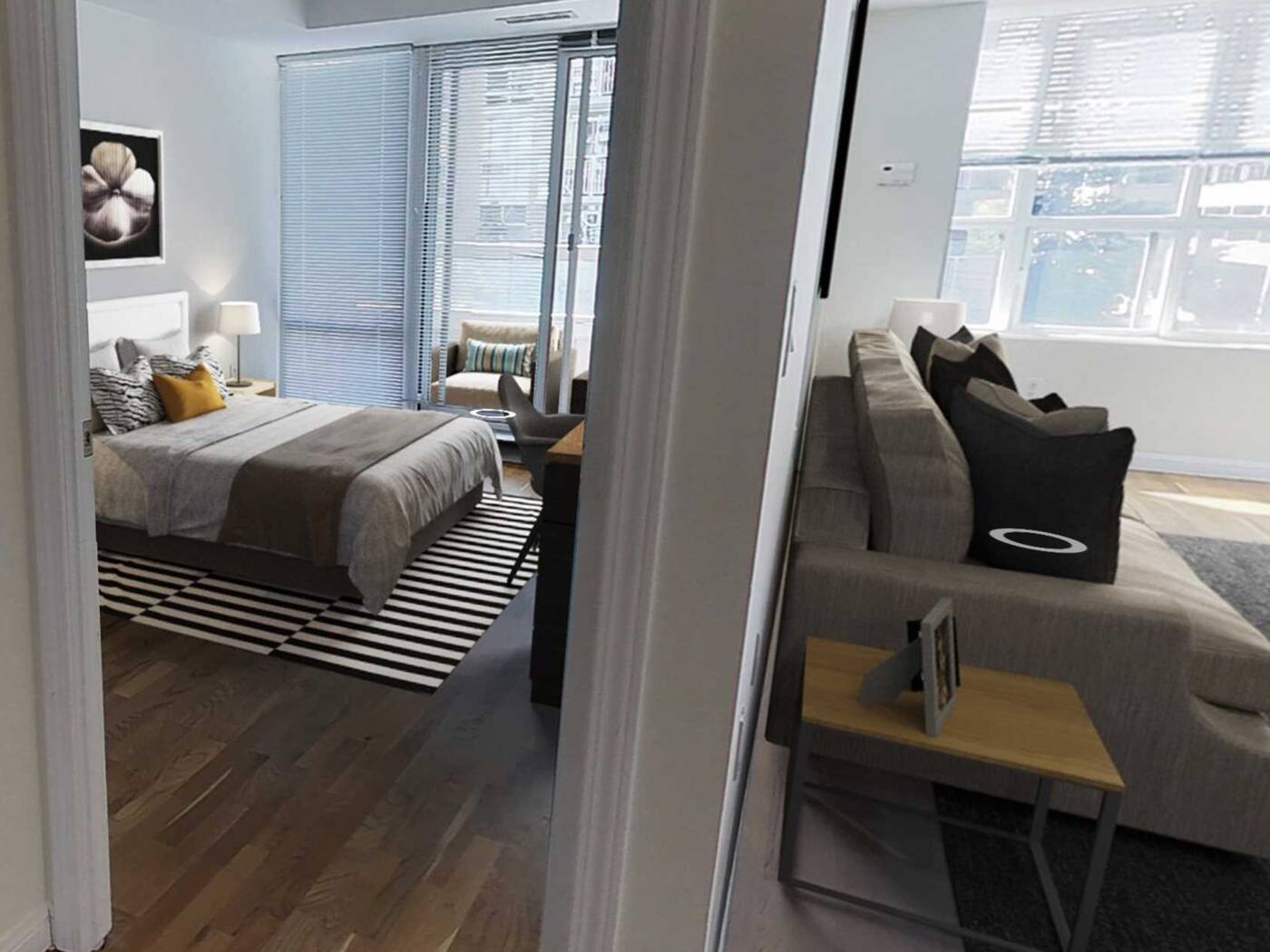

A digitally enhanced picture of the bedroom.

"If house prices go up, the value of your share of the building has gone up, and therefore you aren't falling as far behind if you want to purchase something down the road," Jack Favilukis, a professor of finance at UBC's Sauder School of Business, told the Toronto Star.

But there are risks involved with fractional investing.

Favilukis explained that owning a single property means you're opening yourself up to random risks. For example, if a massive repair needed to happen the investor is on the hook for a portion of those costs.

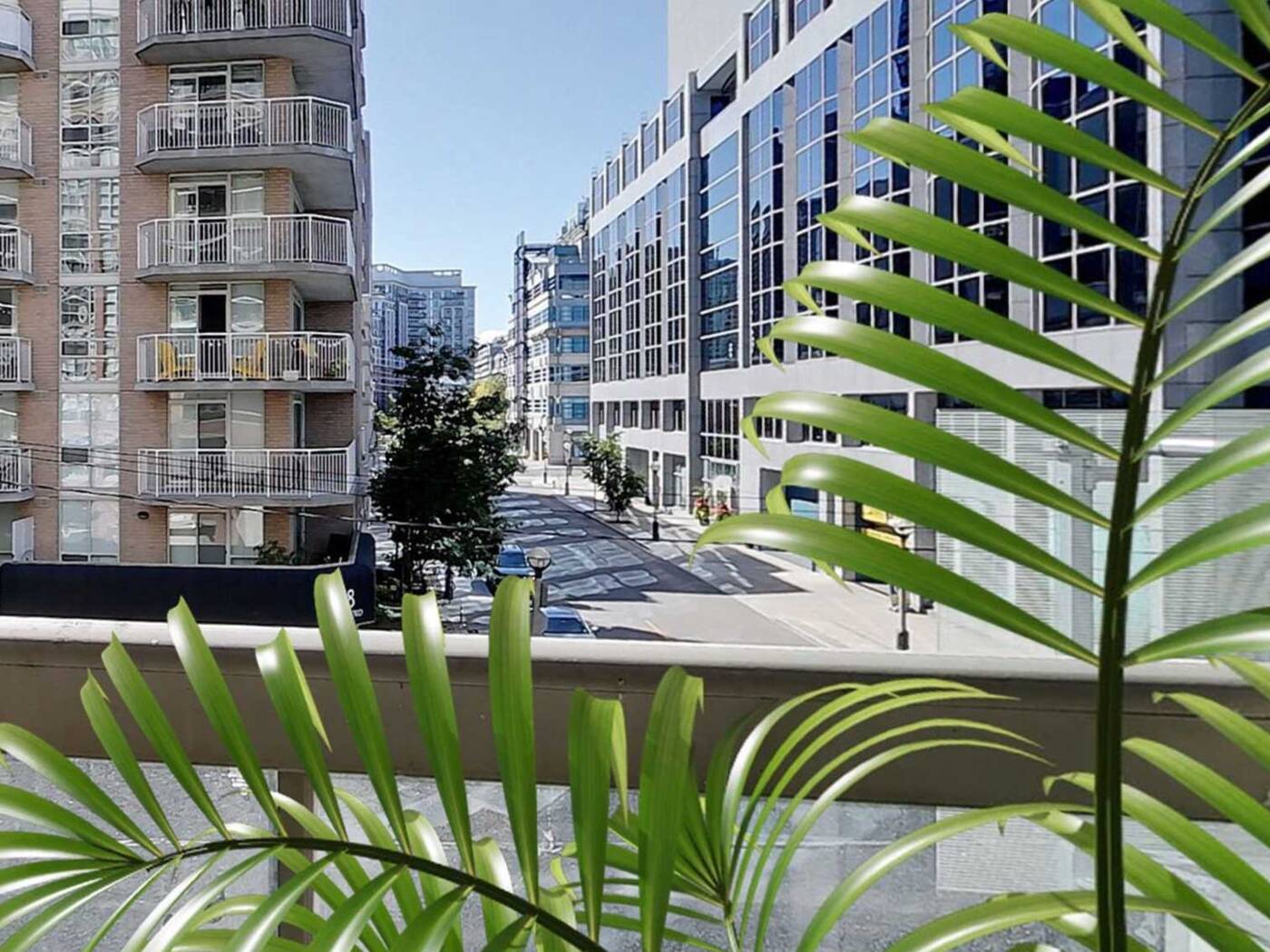

A view from the balcony.

Also it's worth noting that the 15 Stafford St. opportunity is a bit different from traditional fraction real estate investing in that you're not buying a share in a building but rather a portion of an individual condo.

Most fractional real estate investing goes through companies like BuyProperly, NexusCrowd, RealtyShares and Fundrise.

The bathroom.

These companies essentially offer people the opportunity to buy shares in a company that owns a building – much like you'd buy shares in a company on the stock market.

This opportunity is at 15 Stafford St. is more like a co-ownership and as blogTO explored recently, co-ownership is a bit of a nightmare financially and legally.

A digitally enhanced picture of the apartment.

And this fractional co-ownership seems even more complex than a regular co-ownership or fractional investment.

blogTO did reach out to the realtor for clarification on what the terms of this ownership would be but didn't hear back by the time of publication.

So maybe wait until the full condo is on sale?

Latest Videos

Latest Videos

Join the conversation Load comments