The price of a typical Toronto home just shot up by $100,000 in only 3 months

Bubble schmubble, toil and trouble (so much toil, so much trouble) — if the Toronto real estate market is indeed highly overvalued and ready to tank (pop!) it's sure taking a long time to do so.

New data released this week by the Canadian Real Estate Association (CREA) shows that home sales continue to skyrocket across the country as we head toward the end of the year, crushing old records and sending prices through the roof all over the land.

The association reported on Monday that national home sales rose about 8.6 per cent in October on a month-over-month basis, with the MLS home price index rising alongside sales figures by approximately 2.7 per cent.

In terms of the actual national average sale price, it was up by 18.2 per cent in October of 2021 compared to October of 2020, reaching about $770,000. That's Canada-wide.

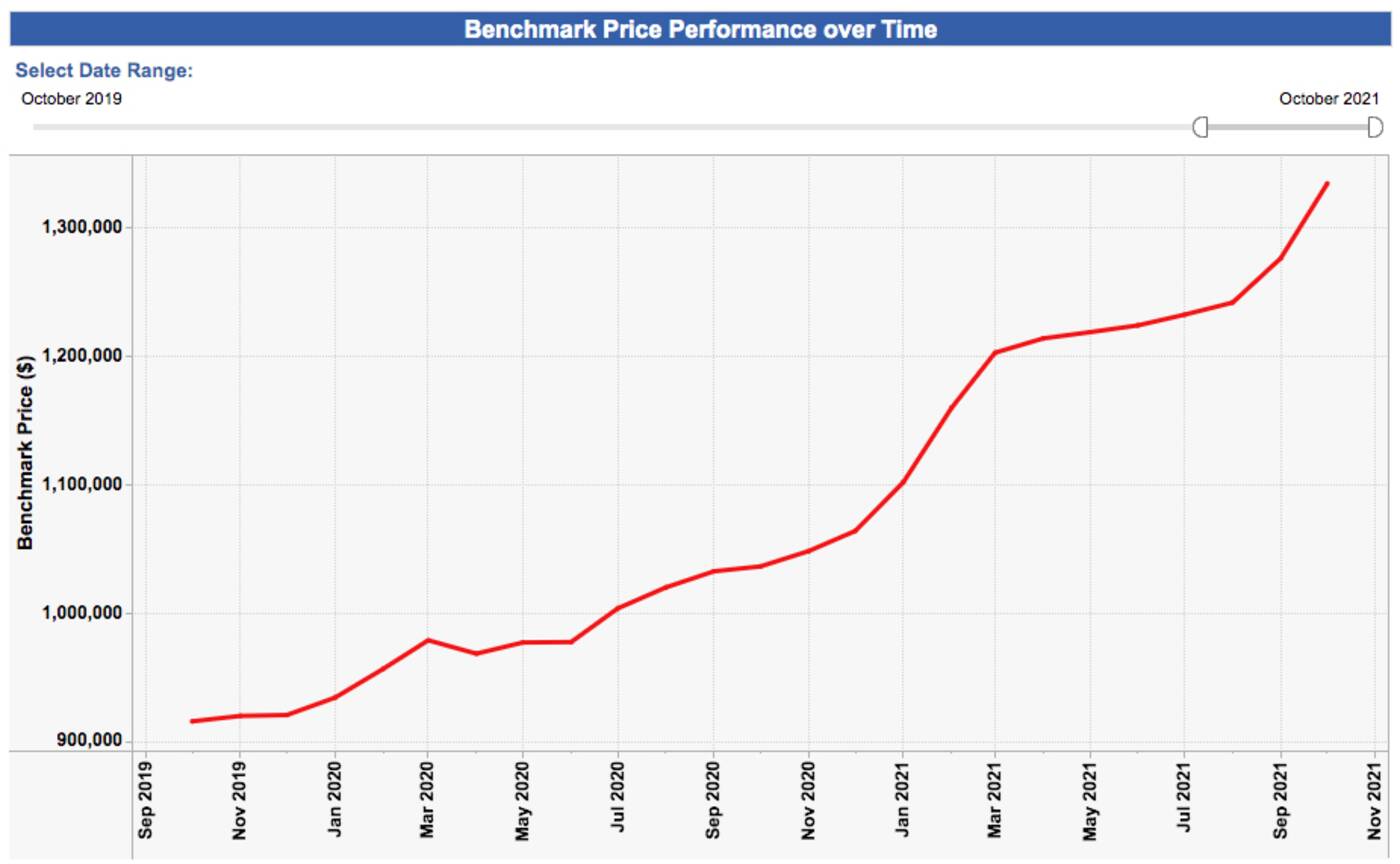

The actual composite benchmark price for all home types (detached, condo, townhouse et. al) in the Greater Toronto Area for October of this year was $1,128,600. Refine this query to single-family homes (read: houses) only, and it comes in at $1,333,400.

In July of 2021, that same figure was $1,231,600. This represents an increase of $101,800 (around 8 per cent) in the benchmark price for houses across the GTA in just three months' time.

Talk about a quick return on one's investment, should one have had the means to purchase a home pre-pandemic or even within the last 12 weeks.

The price of a typical home in the Greater Toronto Area continues to rise exponentially as 2021 continues on. Experts say the hike can be attributed to a lack of supply amid rising demand. Image via CREA.

"After a summer where it looked like housing markets might be calming down a bit, October's numbers suggest we might be moving back towards what we saw this spring, with regards to current market demand and supply conditions," said CREA chair Cliff Stevenson in a release on Monday.

"That said, one month of data is not a trend, so we'll be watching how the balance of this memorable year plays out closely."

Toronto is no longer alone in this kind of market either — the entire GTA is on fire. Some cities in the region, namely Oakville and Milton, are now posting even higher higher typical home price index figures than the 6ix (they were at $1,452,900 on the HPI last month, according to the Globe and Mail.)

Still, as the Globe explains, the home price index for the Toronto region did spike to its highest level since the last time everyone was worried about a bubble back in 2016 and 2017.

And again, it's not only Toronto and its suburbs / outlying cities: Ontario as a whole saw year-over-year price growth closing in on 30 per cent in October, according to the CREA — though, to be fair, the GTA drove much of that growth.

"2021 continues to surprise. Sales beat last year's annual record by about Thanksgiving weekend so that was always a lock, but I don't think too many observers would have guessed the monthly trend would be moving up again heading into 2022," said CREA's senior economist, Shaun Cathcart, of the trend.

"With demand that strong, the supply of homes for sale at any given point in time continues to shrink. It is at its lowest point on record right now, which is why it's not surprising prices are also re-accelerating. We need to build more housing."

Latest Videos

Latest Videos

Join the conversation Load comments