Here's how much home closing costs are in Toronto and 24 other Ontario cities

A home is often the most expensive item someone will ever buy with their hard-earned money, especially in cities like Toronto where the real estate market is out of control.

With the average price of a place to live now sitting around $913,000, it can feel almost impossible to buy property in Ontario's capital — even with a very long term mortgage.

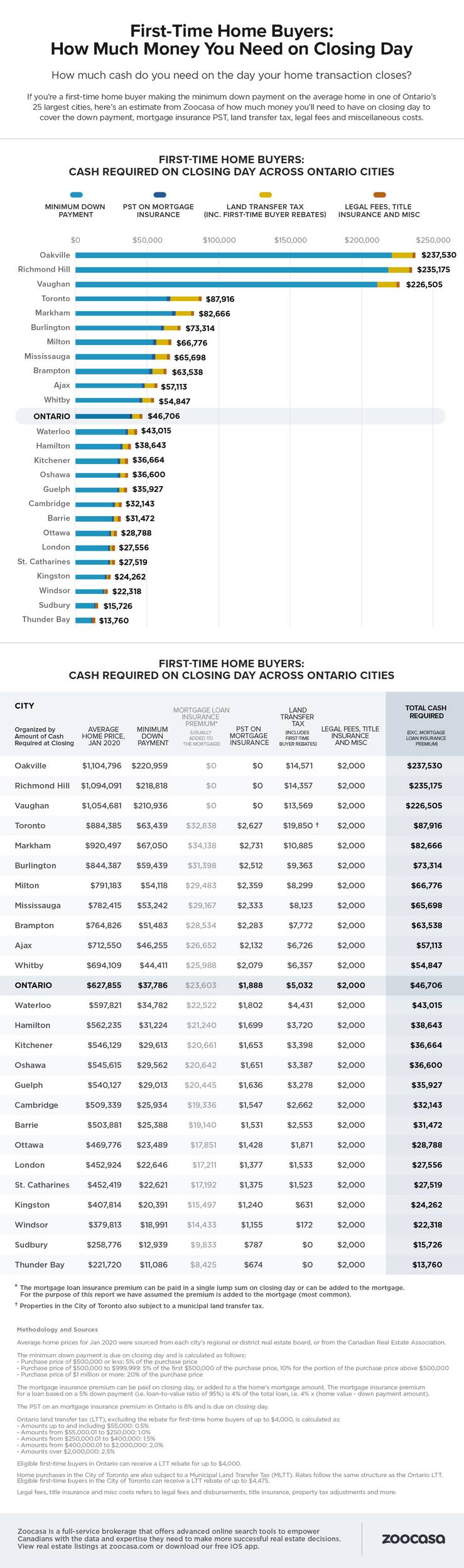

Surprisingly, however, Toronto is only the fourth-priciest city in the province when it comes to closing day costs (which encompass a down payment, PST on mortgage loan insurance premiums, a land transfer tax, legal fees, title insurance and other miscellaneous fees.)

The real estate brokerage and analysis firm Zoocasa determined that first-time home buyers making the minimum down payment in Oakville, Ontario, would actually be hit hardest in the pocket book on closing day, with a final bill of $235,175, on average.

That's more than someone in Thunder Bay — where homes now go for an average of $221,720 — would spend on their entire purchase.

It's also more than someone in the ridiculously-hot market of Toronto would pay in closing costs: According to Zoocasa, the average Torontonian would shell out roughly $87,916 to complete a real estate transaction right now.

"As housing markets and home prices range widely across the province, so too does the amount buyers can expect to pay upon closing," reads the firm's most-recent report.

"To find out how these costs range, Zoocasa compiled estimates based on average home prices in 25 major markets across the province. Calculations assume the minimum down payment is made (and includes the initial deposit amount), that all LTT rebates for first-time home buyers have been applied, and that mortgage default insurance costs have been rolled into the mortgage, and hence do not need to be paid on closing day."

After Oakville, Richmond Hill was found to have the second-highest closing bill at $218,818. Vaughan came in third place with an estimated average closing cost of $226,505.

It's important to note that all three of these markets boast local average home prices that are "comparatively higher than in other Ontario markets" $1,104,796, $1,094,091 and $1,054681 respectively.

Homes over $1 million currently require a minimum down payment of 20 per cent to close, where those between $500,000 and $999,999 require just 10 per cent.

This is why it'll cost less on average for people to close on a home in Toronto, where the average price is still just six figures.

Here's a full breakdown of what you can expect to pay in a single day for a home in any of Canada's top 25 major real estate markets:

Latest Videos

Latest Videos

Join the conversation Load comments