People applaud IKEA Canada for trying to end tax on second-hand items

Canadians are applauding IKEA after the company started a petition calling on the government to end taxes on used items.

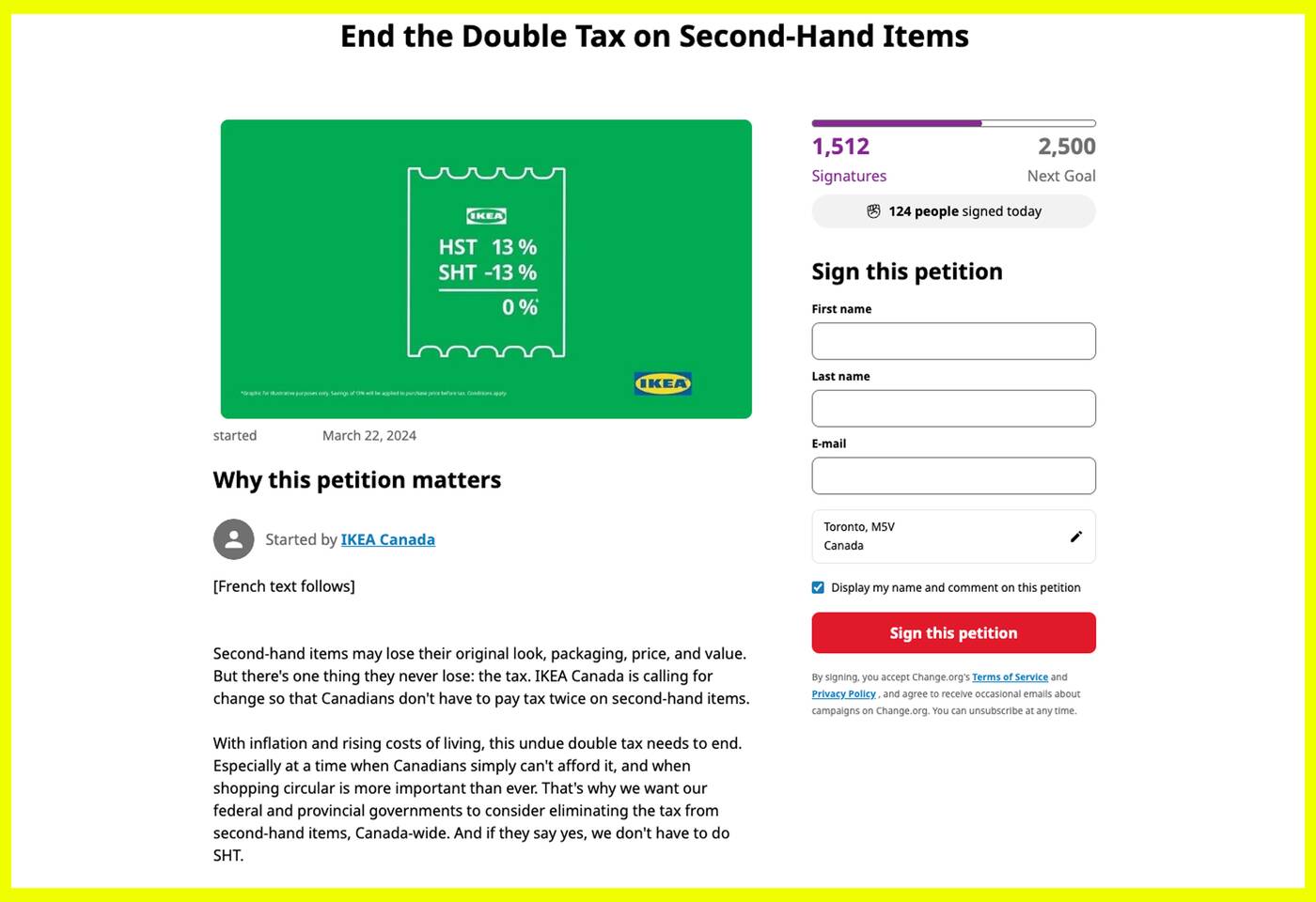

On March 22, the global home furnishing brand posted a petition on Change.org titled "End the Double Tax on Second-Hand Items."

The petition states that Canadians are being taxed for used items even though they may lose their original look, packaging, price, and value. IKEA is calling for changes so consumers "so that Canadians don't have to pay tax twice on second-hand items."

Change.org

IKEA has a Sell-Back Program allows people to resell their used IKEA items to the company, bringing in as much as 50 per cent of the original value. Shoppers can then buy these items in the As-is section at an IKEA store.

According to the Canada Revenue Agency, New Brunswick, Newfoundland and Labrador, and Nova Scotia pay the highest rates for used goods, at 15 per cent. In Ontario, that rate is 13 per cent, while in BC, it's 12 per cent. GST in the rest of Canada is 5 per cent.

"With inflation and rising costs of living, this undue double tax needs to end. Especially at a time when Canadians simply can't afford it, and when shopping circular is more important than ever," reads the statement. "That's why we want our federal and provincial governments to consider eliminating the tax from second-hand items, Canada-wide. And if they say yes, we don't have to do SHT."

As of April 7, the petition has 1,512 signatures out of its 2,500 goal.

Several Canadians support the company's initiative, with one stating, "This is just one more way to promote sustainability!"

Another wrote, "It's ridiculous for the same item to be taxed twice. Just government greed."

One person stated, "Finally, a company has started this petition to end the ongoing tax on a tax that most Canadians are unaware of. Hats off to IKEA Canada for taking the lead on this unfair taxation issue."

Learn more about the petition here.

What are your thoughts on this issue? Let us know in the comments.

ValeStock/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments