New report paints scary picture of household debt in Canada

The current cost of living crisis in Canada is pushing household debt to astonishing levels, as average consumer insolvencies rose by 23 per cent in the country last year, according to a new report.

Ontario-based licensed insolvency firm Hoyes Michalos recently published its annual bankruptcy study, and the findings showed a troubling snapshot of just how deeply in debt Canadians are.

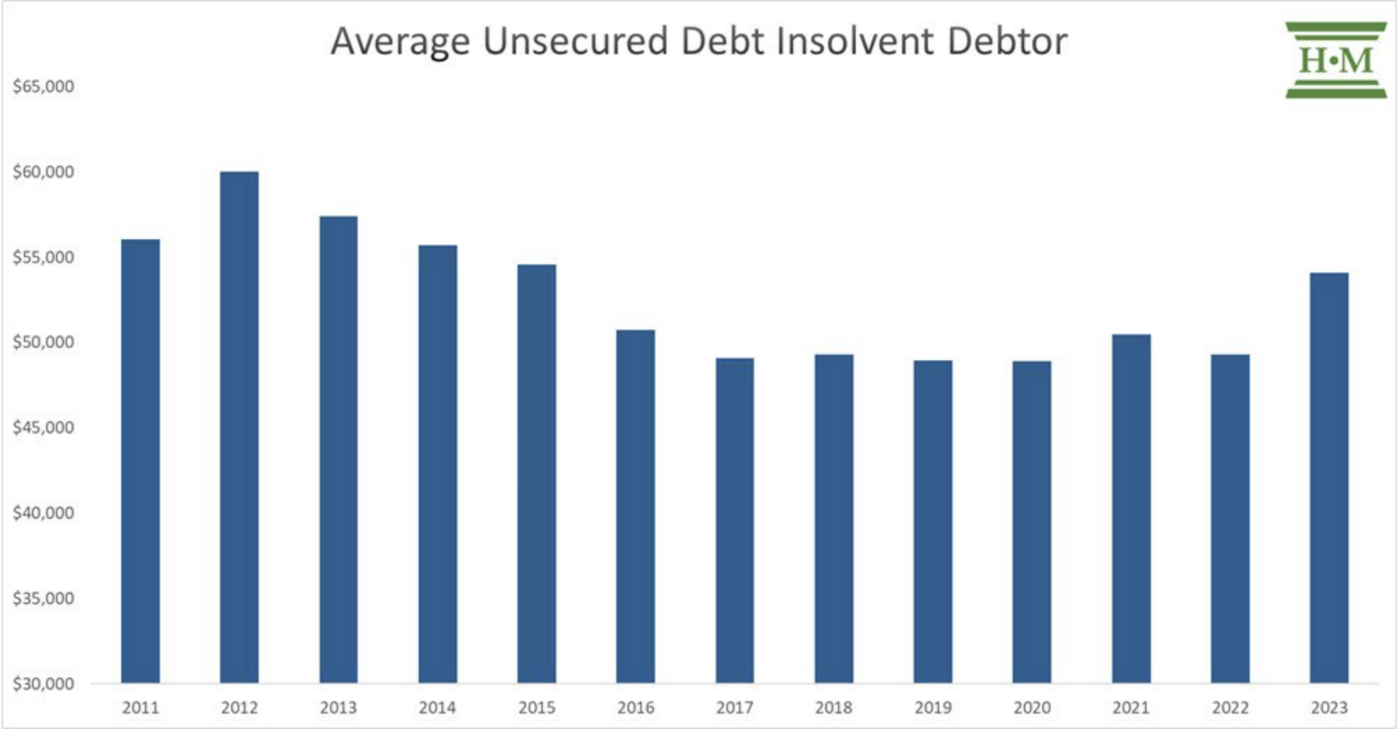

According to the study, the average Canadian insolvent debtor owed $54,084 in unsecured debt in 2023 — a 9.7 per cent increase from 2022 and the highest the firm has seen since starting its study in 2011.

Hoyes Michalos

For the study, Hoyes Michalos referred to the average Canadian insolvent debtor as "Joe Debtor."

Those who fit the "Joe Debtor" profile are usually 43 years old and split evenly between genders, with half living in a single-person household.

The study noted that credit card and homeowner debts are the root cause driving Canadians into the hole.

Canadians are racking up their credit card spending, as 91 per cent of insolvent debtors filed outstanding credit card balances nearing an average of almost $18,000.

"In 2023, we saw the return of credit card debt as problem debt," read the report.

Canada's high interest rates are also impacting homeowner debt.

The report found insolvent homeowners carried a mortgage of $473,575 — a 19.7 per cent increase from 2022.

These individuals also accumulated double the unsecured debt (nearly $77,789) compared to those who didn't own a home.

There is a glimmer of relief for Canadian homeowners in 2024, however, as interest rates are expected to decrease sometime this spring.

Tax debts have a significant impact on Canadians, as well. Nearly half (46 per cent) of insolvent debtors owe tax debt, with amounts increasing by 23 per cent to $20,473 in 2023 compared to 2022.

Debt isn't just a problem for older generations either.

The study noted that younger debtors are rising in Canada, as those aged 18 to 29 saw their credit card debts increase by 34.5 per cent in 2023.

All age groups saw a rise in their credit card balances in 2023, with older Canadian debtors carrying the highest balances.

"Credit card debt balances are increasing as households use credit to make ends meet in a rising cost environment and as indebted homeowners use credit cards to keep up with mortgage payments," stated Hoyes Michalos.

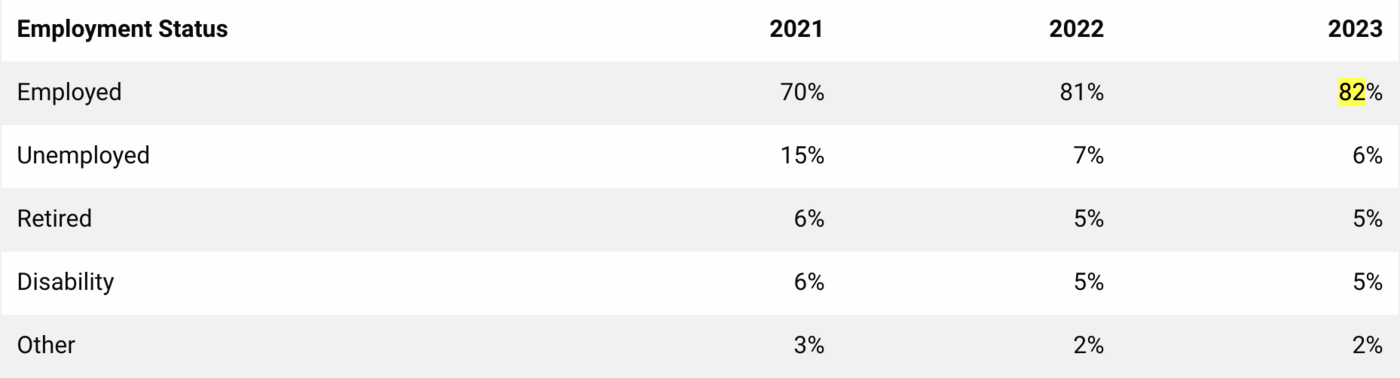

Employed Canadians are also struggling immensely with their debts.

The study found that a whopping 82 per cent of insolvent debtors in Canada were working at the time of filing.

Hoyes Michalos

The report highlighted that the average Canadian in debt also received an 8.6 per cent raise in 2023, while their household income also rose by 12.8 per cent to $3,618.

"This does not mean, however, that Joe Debtor received a raise of 8.6 per cent. In 2023, we saw fewer lower-income filers and more higher-income insolvencies than in prior years," stated Hoyes Michalos.

The report provided little hope for the future of Canadians in debt, noting that as long as the cost of living and interest rates remain high, insolvencies will continue to rise across the country.

Angelo Cordeschi/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments