Future looks grim for Canadian millennials drowning in debt

Canadian millennials are experiencing more debt than ever, and their earnings aren't catching up fast enough to help them make a dent in their payments.

This is according to a new RBC report by economist Carrie Freestone, which highlights that Canadian millennials and younger Gen Xers are in for a stressful financial future thanks to high interest rates and a volatile job market.

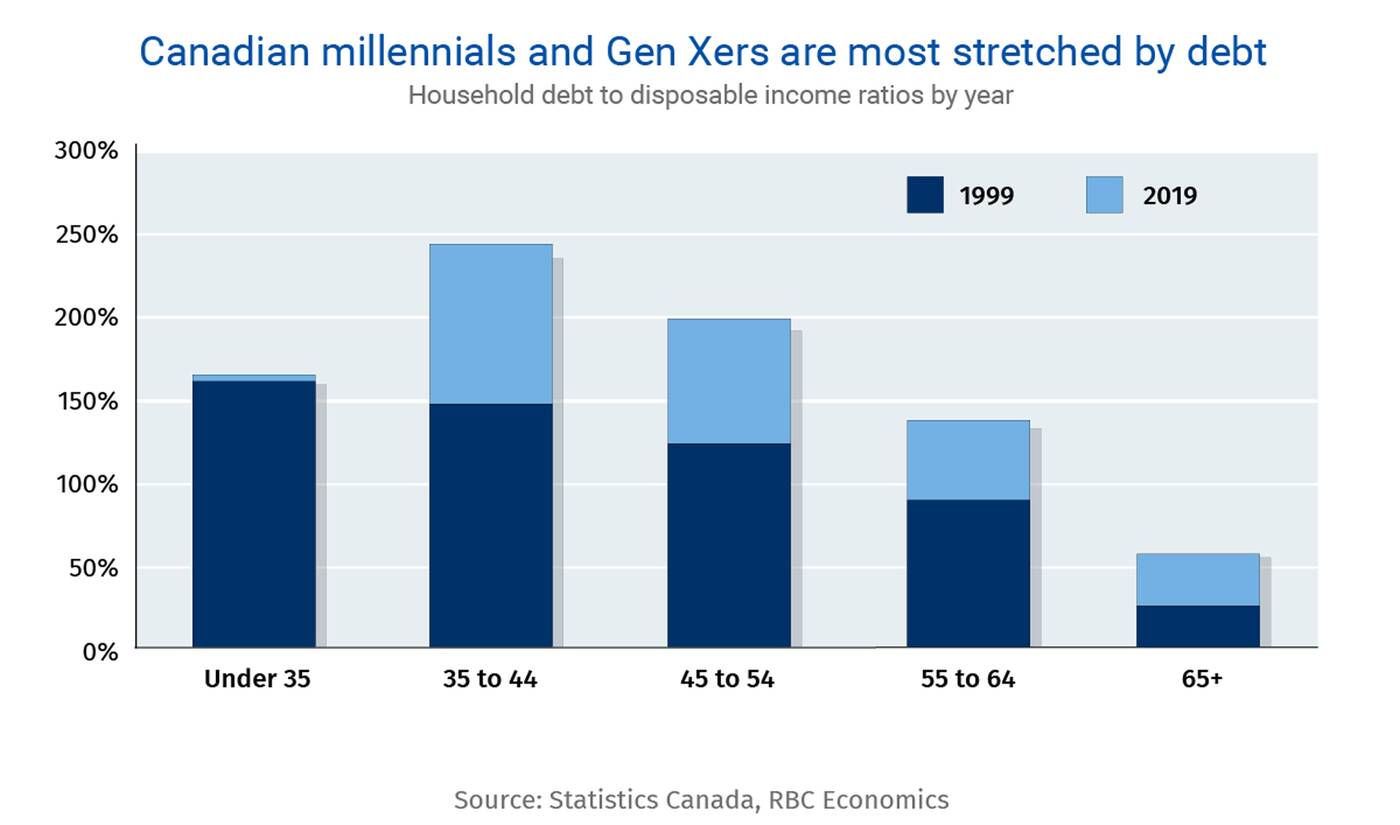

Canadians experiencing debt between the ages of 35 to 44 had a total debt-to-disposable income of 250 per cent in 2019, notes the report.

In comparison, the debt-to-disposable income of Canadians the same age in 1999 was 150 per cent.

Millennials under 35 have experienced significant financial stress as well, accumulating debt loads worth 165 per cent of their disposable incomes in 2019, adds the report.

The situation for millennial homeowners is also looking grim.

The situation for millennial homeowners is also looking grim.

Freestone notes that while not all millennials are homeowners, those who are will experience a "much more dramatic" impact on their monthly payments.

Rising interest rates could see Canadians renewing their mortgages face a staggering 25 per cent increase in their monthly mortgage payments by 2024.

The Bank of Canada increased the rate by 0.25 per cent to 4.75 per cent on June 7 and a further 0.25 per cent to 5 per cent on July 12, following the decision to hold the rate at 4.5 per cent for much of the year to date.

A major reason that younger Canadians are drowning in debt is that their average hourly earnings have only risen 12 per cent since the beginning of the pandemic, which is less than half the increase of the average mortgage payment on a five-year fixed rate.

On the other hand, Canadian boomers (those 65 and older) are experiencing less stress overall when it comes to their financial situation.

Only 14 per cent of Canadian boomers have a mortgage debt and the average amount they owe is half of the average millennial mortgage.

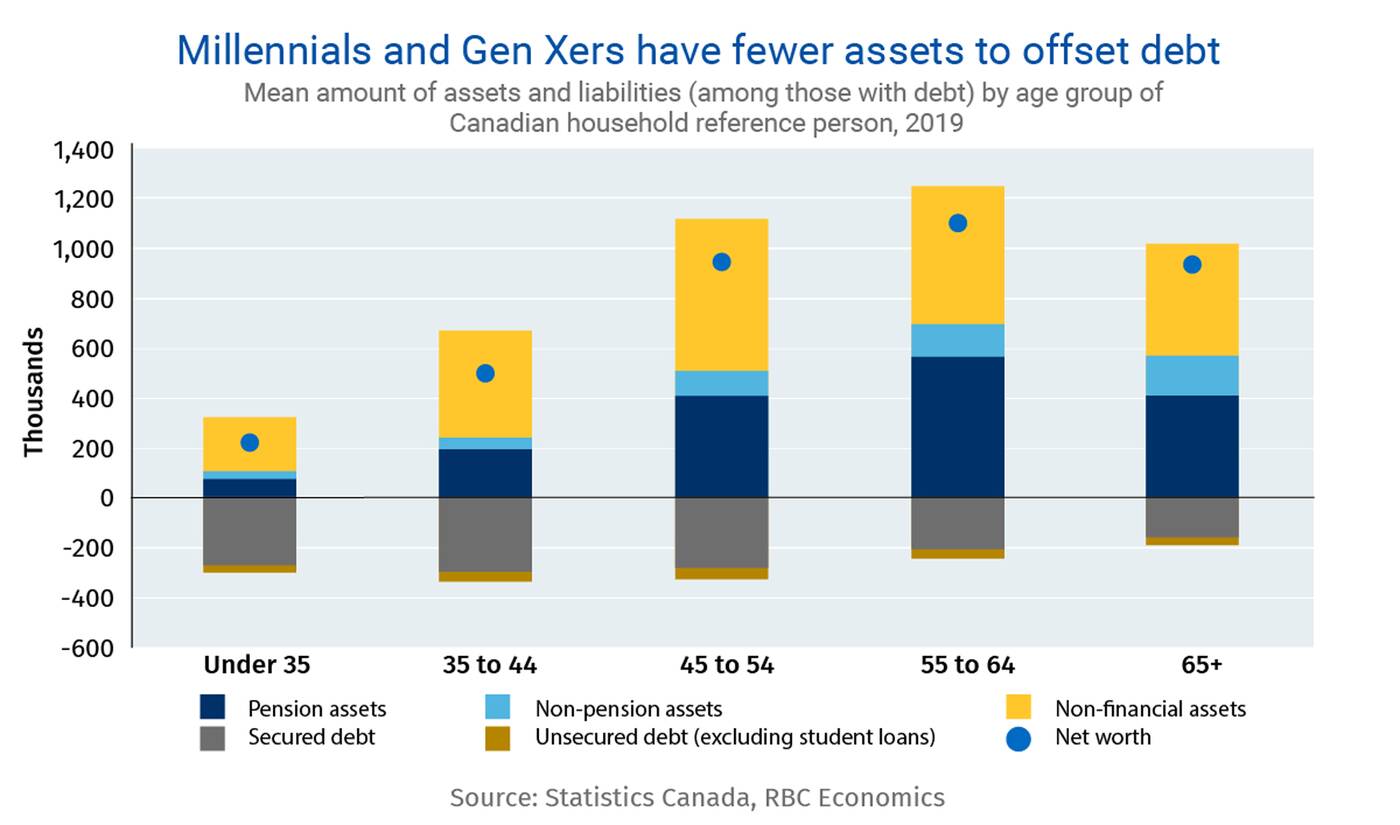

Boomers and older Gen X Canadians (aged 55 plus) also have accumulated more interest-earning assets, which safeguards them when it comes to unexpected financial situations, such as job loss.

They're also the demographic with the lowest spending levels, notes Freestone. Boomers spend over one-third less on goods and services than Canadians in their 30s.

They're also the demographic with the lowest spending levels, notes Freestone. Boomers spend over one-third less on goods and services than Canadians in their 30s.

Millennials and younger Gen Xers also heavily rely on their stable income to pay off their debt debts.

Freestone adds that "while growth is still holding up even after record rate hikes, higher unemployment rates may trigger an entirely different outcome for demand in the year ahead."

With files from Kenneth Chan

Shutterstock/JulieK2

Latest Videos

Latest Videos

Join the conversation Load comments