Near-record number of Canadians worried about bankruptcy

More Canadians say they're likely to declare bankruptcy now than all but one other time in the last 23 years.

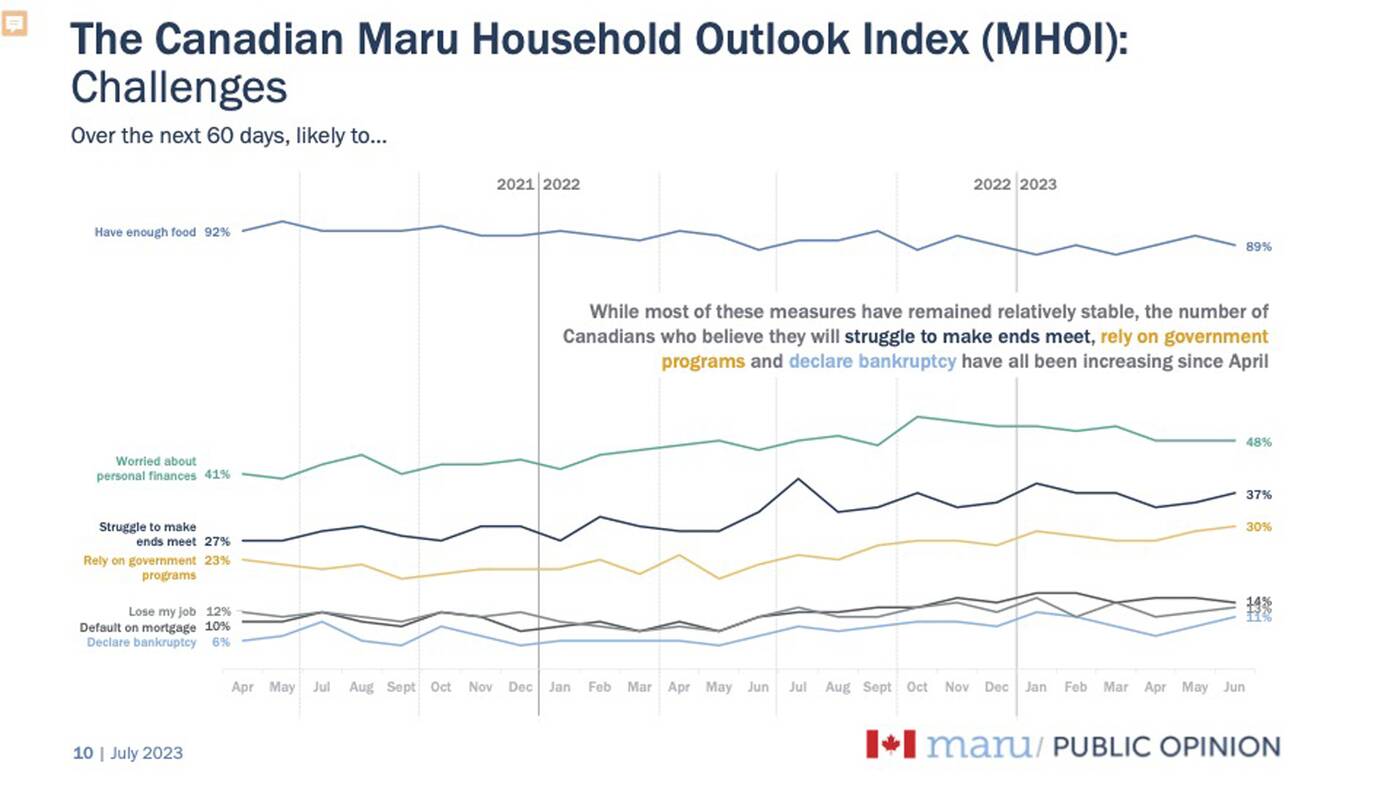

The number of Canadians who say they're likely to declare bankruptcy in the next sixty days is the second-highest it's been since the rate began being tracked in 2000. That's according to the Canadian Maru Household Outlook Index, a monthly report that tracks the personal finances of Canadians.

This month, one in 10 Canadians told surveyors they were likely to declare bankruptcy in the upcoming two months — up from 6 per cent who said the same thing in the spring of 2021.

Canadian Maru Household Outlook Index

By a number of other measures, Canadians' financial outlook is gloomy right now.

More Canadians say their personal financial position is worse than last month, and the number of people who say they're putting money away for retirement is the worst on record since tracking began.

More people also believe they'll lose their job — 13 per cent said they're likely to be laid off, up a full two percentage points from two months ago. As well, 37 per cent of Canadians say they're struggling to make ends meet right now.

The survey was conducted just before grocery rebate payments went out, but ahead of the Bank of Canada raising its benchmark interest rate 25 basis points to 5 per cent on Wednesday — making loans even pricier to repay than they were before.

Latest Videos

Latest Videos

Join the conversation Load comments