What to expect from the next Bank of Canada interest rate announcement

The Bank of Canada will issue an interest rate update on June 7.

This will mark the fourth interest rate announcement of 2023. Four more are scheduled to follow this year.

In 2022, the bank hiked its interest rate seven times. Then, in January 2023, another increase followed, bringing the key rate to 4.5 per cent. Since then, the central bank has held its key rate at 4.5 per cent, precisely as experts predicted.

With the bank not meeting its economic goals, experts are not as confident that the next announcement will follow suit.

Ratehub.ca co-CEO and president of CanWise mortgage lender James Laird shared his thoughts with us.

"The Bank had previously indicated that they would hold the key overnight rate as long as things unfold the way they expected. Since their last announcement, two things have happened that don’t align with their expectations," he told us in an email.

"April inflation and Q1 economic growth, including consumer spending, came in higher than forecasted."

Throughout its rate hike updates, the Bank of Canada has repeatedly cited inflation as the core reason for its decisions.

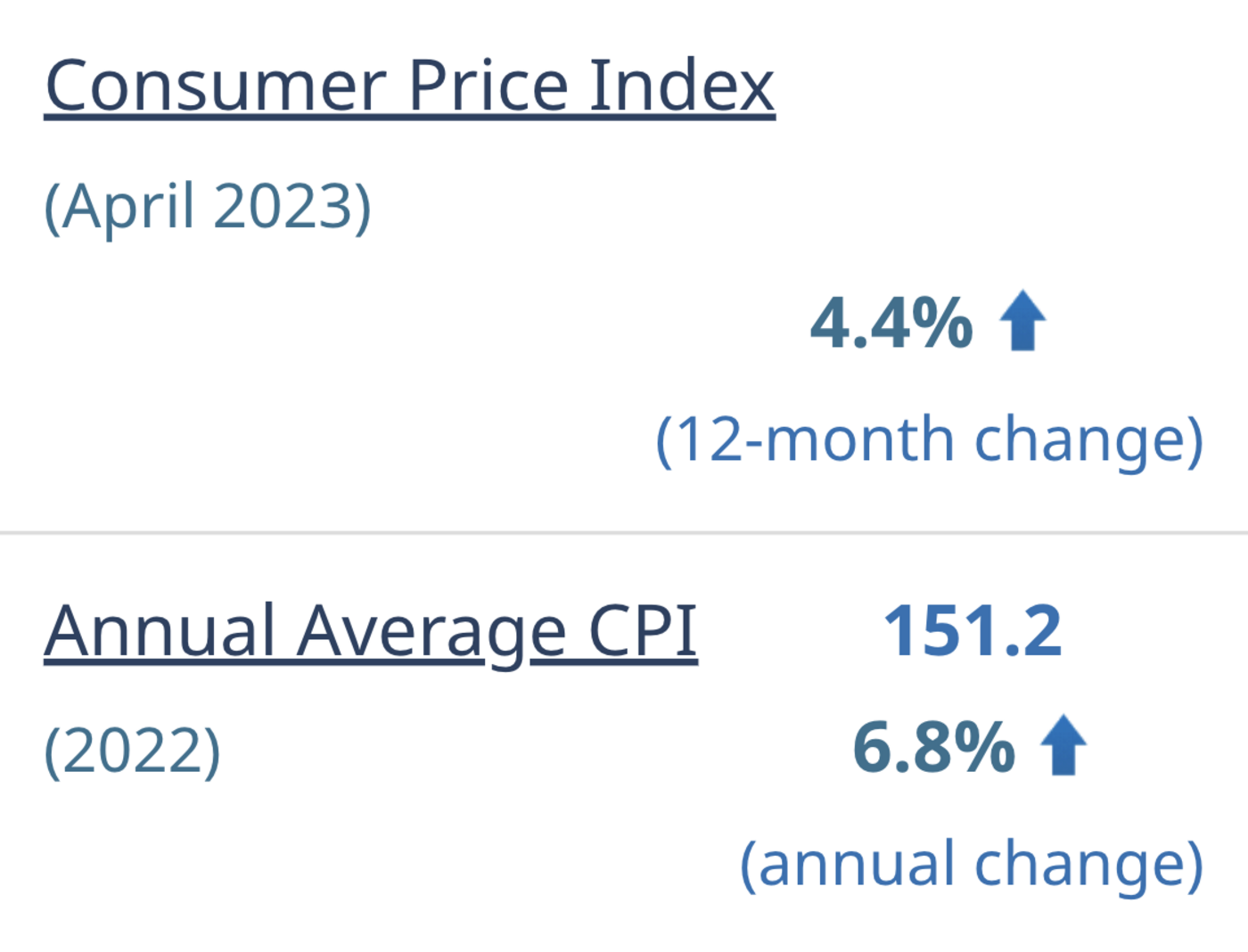

According to Statistics Canada, the Consumer Price Index (CPI) increased 4.4% year over year in April. This came after a 4.3% increase in March.

Statistics Canada

Laird believes a rate increase is possible next week but unlikely. He says the bank will probably wait for future data to observe whether inflation and economic growth realign with their expectations before it hesitates to hike the rate again.

How will this affect your mortgage?

"Because a rate hike is now a possibility, fixed rates have already increased. Variable-rate holders who thought that rate hikes were over will be holding their breath to see if their rates are going to go up even further," noted Laird.

"If the Bank does choose to raise rates further, this will put downward pressure on home values and housing activity as spring turns to summer."

What if the rate goes up on June 7?

Ratehub.ca used its mortgage payment calculator to assess what would happen to a homeowner who put down a 10 per cent downpayment on a $716,083 home with a five-year variable rate of 5.55 per cent amortized over 25 years. This brings the total mortgage amount to $664,453 (monthly payments of $4,075).

Laird says that in this case, if the Bank of Canada does go through with a 25-basis point increase in its rate, the homeowner will see their variable mortgage rate go up by 5.80 per cent.

The $716,083 home price in this example reflects April's average home price in Canada, as observed by The Canadian Real Estate Association.

Latest Videos

Latest Videos

Join the conversation Load comments