These are the cheapest neighbourhoods in Toronto for buying a condo right now

Do you ever think about what kind of place you might be able to buy with all the money you've ever spent on rent living in downtown Toronto? You're not alone.

With average monthly prices rising steeply once again after an all-too-brief reprieve, residents (and prospective residents) of Canada's largest city are increasingly keen on finding out whether or not it makes more financial sense, at this point, to simply buy a home than rent one.

To wit, average Toronto rent prices shot up a whopping 22.8 per cent between February of 2022 and February of 2023, while the average selling price for homes of all types fell 17.9 per cent over the same amount of time.

This doesn't mean that buying is anywhere near easy or affordable in the GTA, however, where the average home now sells for $1,334,062, and historically-high interest rates are keeping many first-time buyers from securing mortgages on homes over $1 million.

Condos, currently selling for an average of $728,271 in the City of Toronto, have thus become an increasingly-popular solution as of late.

"The rising cost of rent was a major theme throughout 2022 and this trend is likely to continue in 2023, driving many prospective buyers to seek more affordable property types," reads a new report from the digital brokerage and analysis firm Zoocasa.

"Reflecting this, the Toronto Regional Real Estate Board recently reported that condo sales were up 34 per cent across the region with selling prices also steadily increasing."

Calling it "the most affordable segment in the market," Zoocasa forecasts sustained buyer demand for condos, which the firm says "remain an especially attractive option for first-time buyers and newcomers to Canada."

Of course, it's a lot easier to save up for a down payment on a condo when you're not already shelling out $2,500 a month to rent a one-bedroom apartment.

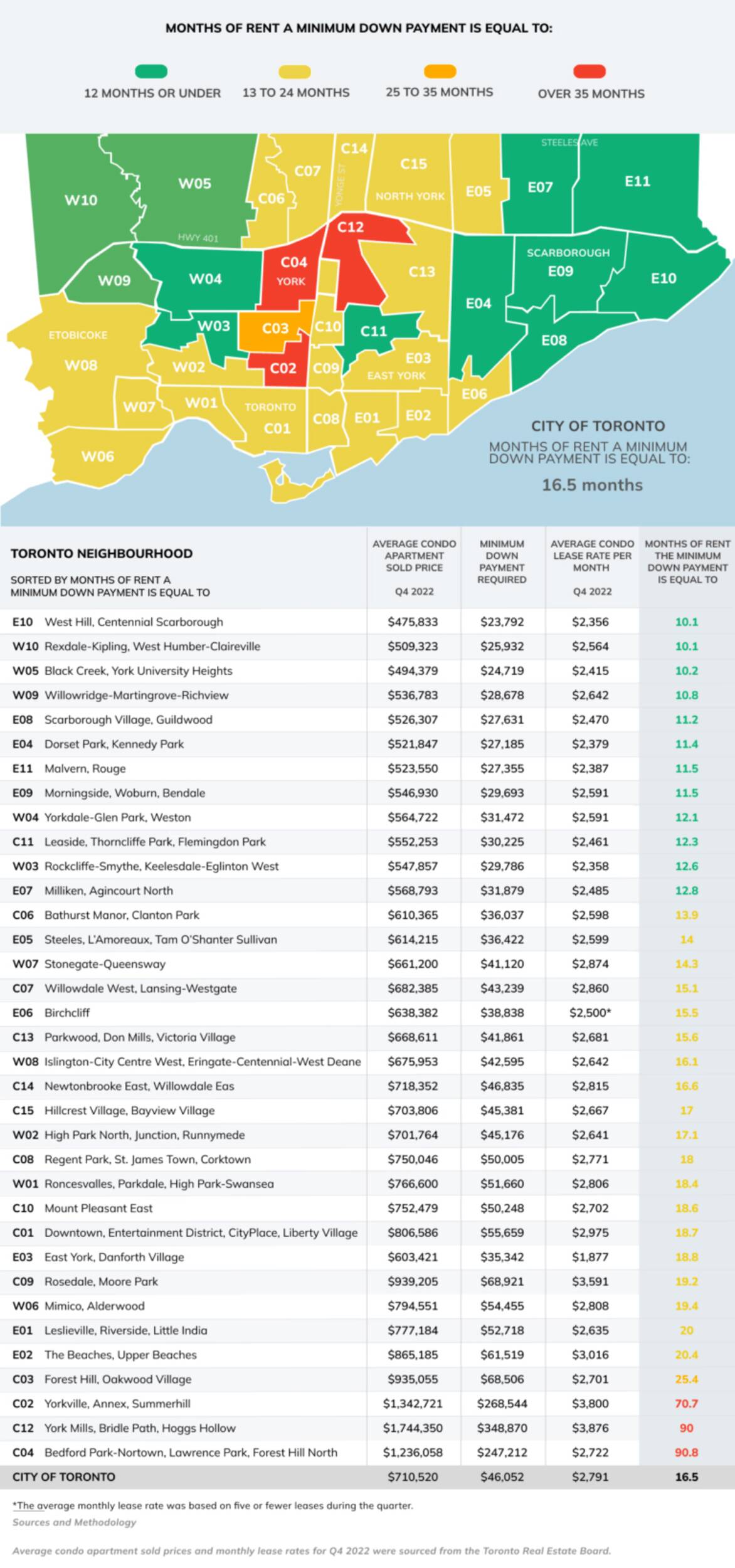

"In the City of Toronto as a whole, an average renter would need to save the equivalent of 16.5 months of rent to come up with the minimum $46,052 down payment necessary to purchase the average condo apartment unit," reports Zoocasa, which recently compared average condo apartment lease rates with sold prices for condos in 35 neighbourhoods across the city.

The study calculated the minimum down payment required to purchase an average-priced condo in each neighbourhood and then broke down the number of months of rent that would need to be squirrelled away to meet that amount.

While it would take as much as 7.5 years of withholding rent payments to secure a condo down payment in Toronto's most-expensive hoods, Zoocasa found that 12 of the 35 neighbourhoods it studied had prices that could be matched within a single year.

You can see how months of rent compare to minimum down payment amounts in all 35 neighbourhoods by clicking here or viewing Zoocasa's graphic below:

Graphic via Zoocasa.

As it turns out, there are still some pockets of Toronto where one can realistically save up for a down payment on a condo in less than a year... if one moves back in with their parents, that is, or secures some other sort of arrangement that would allow them to save up what they would have spent on rent during that time period.

"These more affordable neighbourhoods are primarily located on the edges of the city in places like Scarborough Village, Yorkdale-Glen Park Weston, West Hill, Rouge, Thorncliffe Park, and Black Creek," reports Zoocasa.

"As expected, heading closer towards the centre of the city will increase the necessary minimum down payment required, with the majority of neighbourhoods in the 13 to 24 months range."

Here, via Zoocasa, are the top five Toronto neighbourhoods with the shortest down payment savings timeline as of early 2023.

- West Hill, Centennial Scarborough

Average Condo Price: $475,833

Minimum Down Payment: $23,792

Average Monthly Lease Rate: $2,356

# of Rent-Free Months to Save Down Payment: 10.1

- Rexdale-Kipling, West Humber Clairville

Average Condo Price: $509,323

Minimum Down Payment: $25,932

Average Monthly Lease Rate: $2,564

# of Rent-Free Months to Save Down Payment: 10.1

- Black Creek, York University Heights

Average Condo Price: $494,379

Minimum Down Payment: $24,719

Average Monthly Lease Rate: $2,415

# of Rent-Free Months to Save Down Payment: 10.2

- Willowridge-Martingrove-Richview

Average Condo Price: $536,783

Minimum Down Payment: $28,678

Average Monthly Lease Rate: $2,642

# of Rent-Free Months to Save Down Payment: 10.8

- Scarborough Village, Guildwood

Average Condo Price: $526,307

Minimum Down Payment: $27,631

Average Monthly Lease Rate: $2,470

# of Rent-Free Months to Save Down Payment: 11.2

Latest Videos

Latest Videos

Join the conversation Load comments