Canada's housing crisis has people wanting to live at home forever

The federal government rolled out a tax credit aimed at helping families live in the same household, but is it doing enough to help with the housing crisis?

As of January 1, the Multigenerational Home Renovation Tax Credit is available to claim for families constructing a secondary suite "for a family member who is a senior or an adult with a disability."

Prime Minister Justin Trudeau said the tax credit "will maintain traditions of multiple generations living together – and help more Canadians find a safe, affordable place to call home."

Introducing the Multigenerational Home Renovation Tax Credit: You can get up to $7,500 to add another unit to your home for family members. This will maintain traditions of multiple generations living together – and help more Canadians find a safe, affordable place to call home.

— Justin Trudeau (@JustinTrudeau) January 20, 2023

According to the 2022 budget, it's a refundable credit that would let families claim 15 per cent of up to "$50,000 in eligible renovation and construction costs incurred in order to construct a secondary suite." There are some rules and restrictions around eligibility for the tax credit.

The move fulfills a campaign promise made by the Liberal Party. Part of the Liberal Housing Plan included the tax credit meant "for families wishing to add a secondary unit to their home for the purposes of allowing an immediate or extended family member to live with them."

The Liberals said it would "provide up to $7,500 in support and help make communities more livable while bringing families closer together and better able to care for one another."

Daniel Foch, a host of the Canadian Investor Podcast, calls it the start of the "'live at home forever' policy phase of the housing crisis."

"To be honest, I was being a little facetious about the tax credit in response to the Prime Minister’s original tweet, because it didn’t disclose much detail about the policy but used the word "multigenerational", so it sounded like it was going to be designed for millennials to live in their parents’ basements forever," Foch said.

"However, the "live with your parents forever" part of the TikTok, could also refer to the fact that the policy is designed to create in-law suites to have seniors (65+) move back in with their family to age-in-place."

"The most common utility for this credit as a millennial homeowner would be having your parents move back in with you to consolidate living expenses, avoid expensive retirement homes, and reduced homeownership costs."

According to Statistics Canada, living with extended family members has been a growing trend. Close to a million households in 2021 were "composed of multiple generations of a family," representing 7 per cent of overall households.

"I think multigenerational living can be a beautiful thing for many – especially seniors who want to age in place, or time-scarce millennials who could benefit from having family around to help with everyday life," said Foch.

"We see this style of living done gracefully and naturally in many cultures and parts of the world. So, to be honest, I think the spirit of the policy is great, but the execution is a little off, and the timing does raise a few red flags for me," he said.

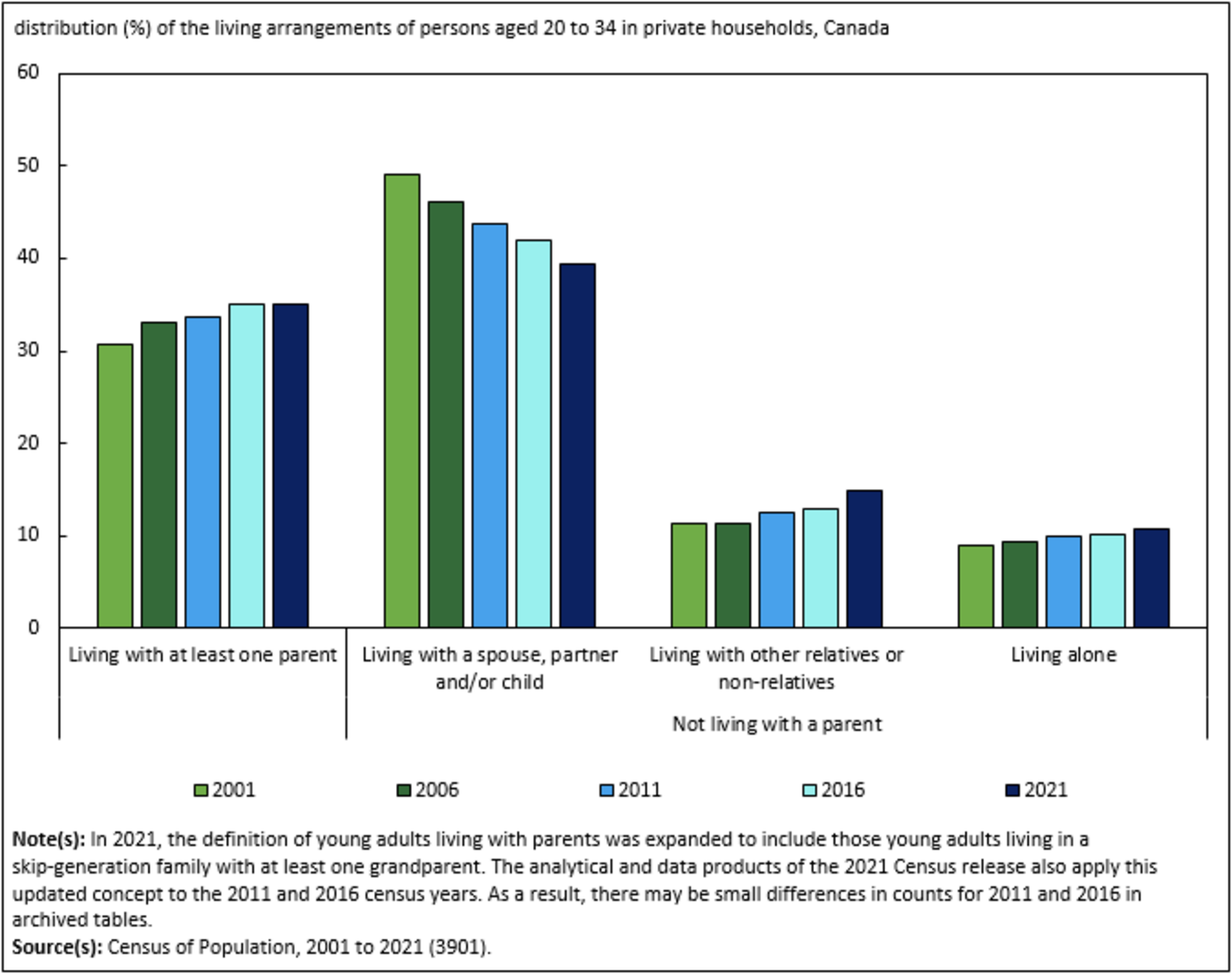

There is a decent number of young people who live with a parent, but that number has started to plateau, according to Statistics Canada.

The share of young adults aged 20 to 34 living in the same household as at least one of their parents was unchanged from 2016 to 2021 (35 per cent).

"However, the age profile of young adults who lived with their parents continued to shift to older ages: in 2021, 46 per cent of young adults who lived with their parents were aged 25 to 34, compared with 38 per cent in 2001, Statistics Canada said.

Statistics show that young adults are moving out of their family homes at an older age than they were 20 years ago. Source: Statistics Canada

The new multigenerational home tax credit is just one of many updates from the federal government to address housing affordability in Canada. Other initiatives include:

- A top-up to the Canada Housing Benefit

- A two-year ban on foreign purchases of Canadian houses

- A 1 per cent annual vacant home tax on foreign-owned underused housing

- Applying GST/HST to all assignment sales of newly constructed or substantially renovated residential housing

- Doubling the First-Time Home Buyers' Tax Credit

- Creating a tax-free savings account to save money to buy your first house

- And more

According to Foch, we have a number of challenges we’re facing that still need to be addressed.

"This is a policy seemingly designed to create household consolidation – which reduces household formation and therefore, reduces demand. It is disguised as a supply-side measure, but it’s ultimately intended to be demand-reducing," he said.

"This type of policy indicates that Canada could ultimately be heading for a low-ownership housing model as more people are marginalized out of ownership. This really signals that we’re starting to see the end of the Canadian dream of homeownership unless something changes," he said.

What do you think of this tax credit?

Hector Vasquez

Latest Videos

Latest Videos

Join the conversation Load comments