Toronto homeowners pay the lowest property tax rates in all of Ontario

Buying a house in Toronto, if you're one of the few who can actually afford to do so anymore, is exorbitantly expensive when looking at the purchase straight on: The average price for a detached residence in the city is now more than $1.5 million.

Proportionately, however, based on the property taxes you'd need to pay every year, it's actually cheaper to live in Toronto than anywhere else in Ontario.

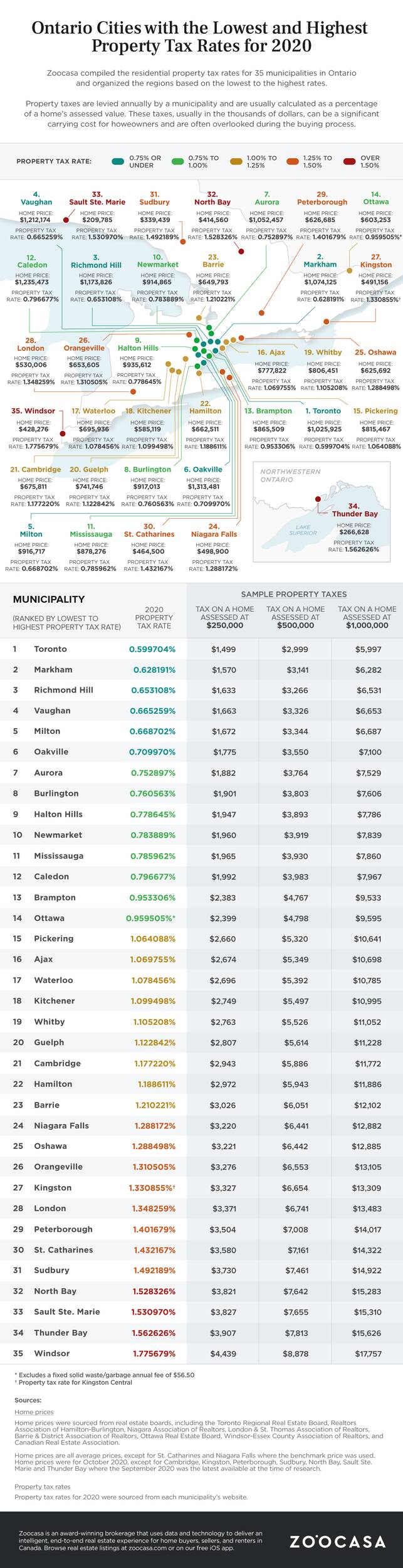

The real estate listing and analysis firm Zoocasa just released a report detailing how Toronto's infamously-low property tax rates came to be, and how Canada's largest city stacks up against 34 other municipalities across the province.

With young people leaving the city in droves to seek out larger, more-affordable spaces in smaller Ontario cities, there's never been a better time to consider just how big an impact this recurring annual expense will have on one's bank account over the years.

"It's important for buyers who are moving to a new municipality to note that the property tax rate their home is subject to and the total amount they pay in taxes every year will change as municipal tax rates vary widely across Ontario," reads the report.

"Depending on the municipality, the difference paid annually can be thousands of dollars depending on the size of the city, its council's operating budget, and even factors such as the health of its housing market."

Zoocasa rounded up #propertytax rates for 2020 across 35 Ontario municipalities, and calculated what homeowners could expect to pay in taxes at three sample assessment values in each region. Read our report here: https://t.co/vUXttdNJPs pic.twitter.com/x36Ew0uJtk

— Zoocasa (@zoocasa) November 12, 2020

Zoocasa calculated how much homeowners would pay in 35 different Ontario regions based on 2020 property taxes at three different assessment values: $250,000, $500,000 and $1,000,000.

"In Windsor – which features the highest property tax rate among the municipalities included on our list at 1.775679% – a homeowner would pay $8,878 per year in property taxes on a home assessed at $500,000," the report notes.

"By comparison, in the City of Toronto – which has the lowest tax rate at 0.599704% among the municipalities included on our list – a homeowner would pay a comparatively lower $2,999 for a property assessed at $500,000."

Sounds strange, but it's true — though it's important to note that a $500,000 home in Toronto would be much, much smaller, and likely farther away from the downtown core than a similarly-priced home in Southwestern Ontario.

As for why Toronto's property taxes are so comparatively low, Zoocasa explains that it's up to individual city councils to set property tax collection rates.

"In Toronto, for instance, city council has purposely kept the residential tax rate below inflation as a promise to voters," states the report. "Keeping property taxes low can also act as an incentive to draw more buyers to a city’s property market."

The report also notes that cities with "high-valued local real estate and larger populations" have more leeway on keeping tax rates low, as they're collecting more money from more people in more-expensive houses, generating sufficient cash to float the operating budgets of their respective councils.

You can read more about the why and how here, and see which cities have the highest and lowest property tax rates as of 2020 below:

Latest Videos

Latest Videos

Join the conversation Load comments