Millennials in Ontario are increasingly worried about their financial future

Ontario's Millennials share a not-too-rosy outlook on their financial futures, according to a new report diving into the concerns and fears of a generation aging into an ever-worsening cost of living crisis.

The annual RBC Financial Independence Poll for 2024 paints a worrying picture of the Millennial state of mind in Ontario. Anxieties are flaring up as the generation approaches middle age, with the vast majority of Ontario Millennials aged 27 to 42 concerned about how they will manage in the years to come.

These Millennials are now aging into the same financial concerns as their Gen X predecessors as retirement moves from a distant dream to a reality to start planning for.

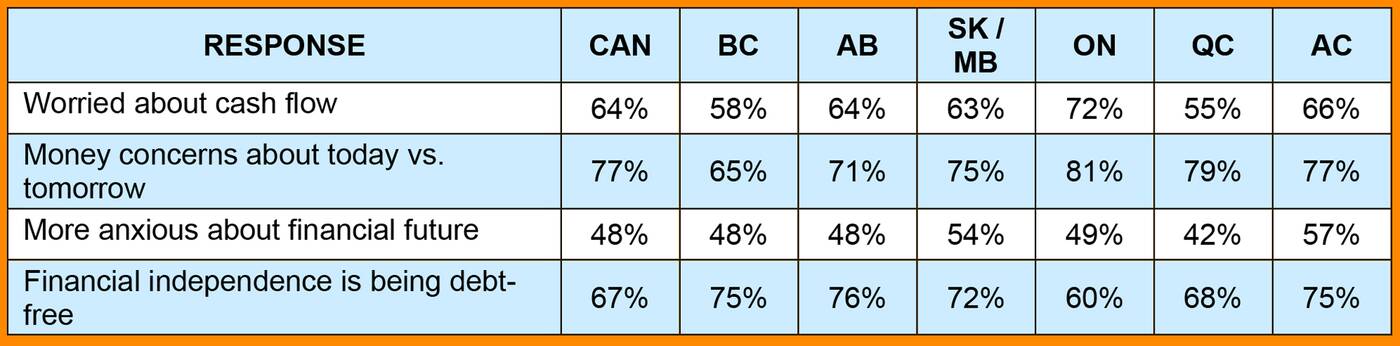

According to the report, a not-too-shocking 72 per cent of Ontario residents aged 18 and older are likely to say they are worried about their cash flow compared to a national average of 64 per cent — the province registering the highest percentage of any region in the country.

Similarly, Ontario adults are more worried about how to balance covering day-to-day expenses with saving for the longer term, at 81 per cent compared to a national average of 77 per cent. Once again, Ontario residents showed more concern than anywhere else polled in Canada.

While 67 per cent of Canadian adults define financial independence as being debt-free, only 60 per cent of their Ontario counterparts agree as the generation takes on more debt to cover the cost of living.

Only half of respondents in the province said that retiring comfortably is an investing goal — tied for the lowest confidence in retirement in Canada. However, in contrast, more Ontario residents (48 per cent) consider building wealth as a goal compared to the national average of 37 per cent.

RBC

On a nationwide level, Millennials aged 27-42 were more concerned than Gen X and the combined 18+ population over factors like cash flow and savings. Millennials polled were also more willing to pay fees for higher returns on investments than Gen Xers and the entire 18+ demographic.

These findings align closely with the 2024 version of BMO's Annual Retirement Survey, which determined that millennials believe they need more than $2 million in savings to exit the workforce and retire comfortably.

eskystudio/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments